Working Paper Series no. 693: Inefficient Short-Time Work

This paper shows that the reforms which expanded short-time work in France after the great 2008-2009 recession were largely to the benefit of large firms which are recurrent short-time work users. Pierre Cahuc and Sandra Nevoux argue that this expansion of short-time work is an inefficient way to provide insurance to workers, as it entails cross-subsidies which reduce aggregate production. An efficient policy should provide unemployment insurance benefits funded by experience rated employers’ contributions instead of short-time work benefits. They find that short-time work entails significant production losses compared to an unemployment insurance scheme with experience rating.

Also called short-time compensation, short-time work is a public program targeted at firms facing temporary negative shocks. The design aims at reducing job destruction through work-sharing, by subsidizing firms to lower hours of work while providing earnings support to employees facing these reduced hours. Short-time work can avoid inefficient job destruction induced by firms facing limited access to credit due to capital market imperfection. In many countries of the Organization for Economic Cooperation and Development (OECD), firms facing seasonal fluctuations in their revenue can make recurrent use of short-time work. This issue has been neglected by researchers, who have focused on short-time work when firms face temporary shocks. This issue is important, however, because sectors affected by seasonal fluctuations have strong incentives to lobby to benefit from short-time work schemes that would allow recurrent use of short-time work.

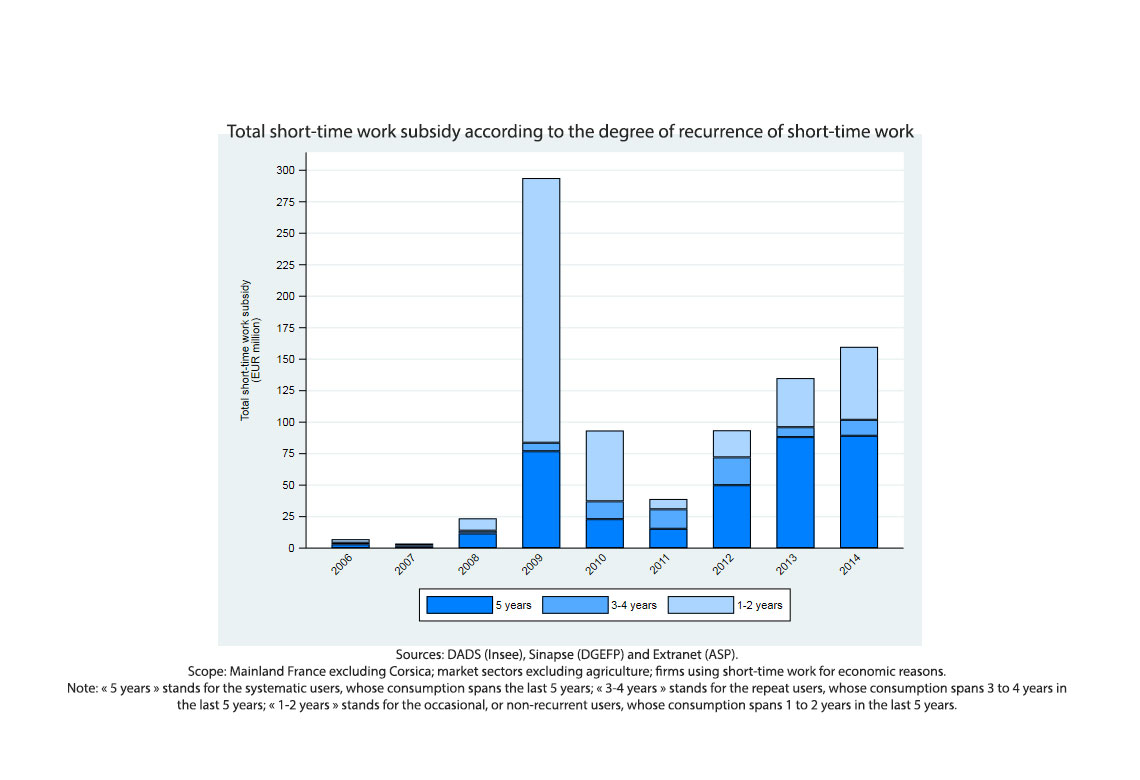

In France, before the great 2008-2009 recession, the short-time work scheme was very limited, with a tiny budget fluctuating between 5 and 10 million euros per year. However, in 2009, the budget expanded significantly, to about 300 million euros. This expansion was induced by a strong increase in the demand from firms in distress but also by the government, which decided to facilitate access to short-time work and to raise short-time work subsidies in order to sustain employment. In November 2009, a government report, co-directed by three representatives of large firms and one civil servant, recommended pursuing the expansion of short-time work beyond the end of the recession. In January 2012, once the recession was over, employers’ organizations and trade unions signed a national agreement to enlarge the program further and to raise the subsidies. This national agreement was implemented by a number of decrees enacted to raise the budget devoted to short-time work. As a consequence, from 2013 on, the expenditure on short-time work was multiplied by about 20 compared with its pre-recession level.

Relying on rich data providing detailed information about all short-time work subsidies from 2002 to 2014, we show that this hike in public expenditure primarily benefited large firms which recurrently use short-time work to deal with seasonal activity fluctuations. Then, we present a model which shows that this expansion of short-time work induces cross-subsidies towards recurrent short-time work users, which reduce aggregate production. Our model shows that an efficient policy should instead provide unemployment insurance benefits funded by experience rated employers’ contributions. In the unemployment insurance scheme with experience rating, employers can lay the workers off during the unproductive periods but have to pay for the induced cost to unemployment insurance. This system induces employers to internalize the costs of their layoffs. It incentivizes employers to keep their employees during unproductive periods to avoid increasing unemployment insurance contributions. Conversely, short-time work is not incentive compatible if it is experience rated, since the introduction of experience rating in short-time work reduces its attractiveness for employers and hence diminishes short-time work take-up. Obviously, short-time work is a means to keep employees in their jobs if it induces small costs to the employers. However, this is an inefficient way to provide insurance, as it entails cross-subsidies towards short-time work users which reduce aggregate production. Nevertheless, this is the path taken by French reforms after the recession, under the pressure of industries which could prospectively benefit from the short-time work subsidies. Relying on our model, we arrive at the assessment that the production loss associated with short-time work, compared to a system of unemployment insurance with experience rating, is significant: it amounts to about 50% of the total amount of short-time work subsidies targeted at recurrent short-time work users.

These results are a call for a careful design of short-time work and unemployment insurance. In all countries where short-time work exists, the short-time work hourly benefits paid to the employees for each unworked hour represent a fraction of the hourly wage. In some countries, the employers pay a portion of the benefits and the other part is financed by public subsidies. In other countries, the benefits are entirely financed by public subsidies but experience rated social contributions entail that employers have to pay back a fraction of the short-time work cost through higher social contributions in the future. In yet other countries, employers bear no short-time work cost at all. Our results stress that systems where employers contribute little to short-time work induce firms facing strong seasonal revenue fluctuations to make recurrent use of short-time work, which reduces aggregate production. Given that, it is important to limit the recurrent use of short-time work. An efficient way to achieve this objective may be to rely on an experience rated system, where employers have to pay back a fraction of the short-time work cost through higher social contributions in the future. This system allows firms facing short-term financial constraints to sustain employment without inducing cross-subsidies which reduce aggregate production. Since the introduction of experience rating in short-time work reduces its attractiveness for employers, it induces a reduction in the short-time work take-up rate. Accordingly, this system should be complemented by mandatory unemployment insurance with experience rated employers’ contributions to insure workers.

Download the PDF version of this document

- Published on 09/11/2018

- 32 pages

- EN

- PDF (440.39 KB)

Updated on: 10/08/2018 17:22