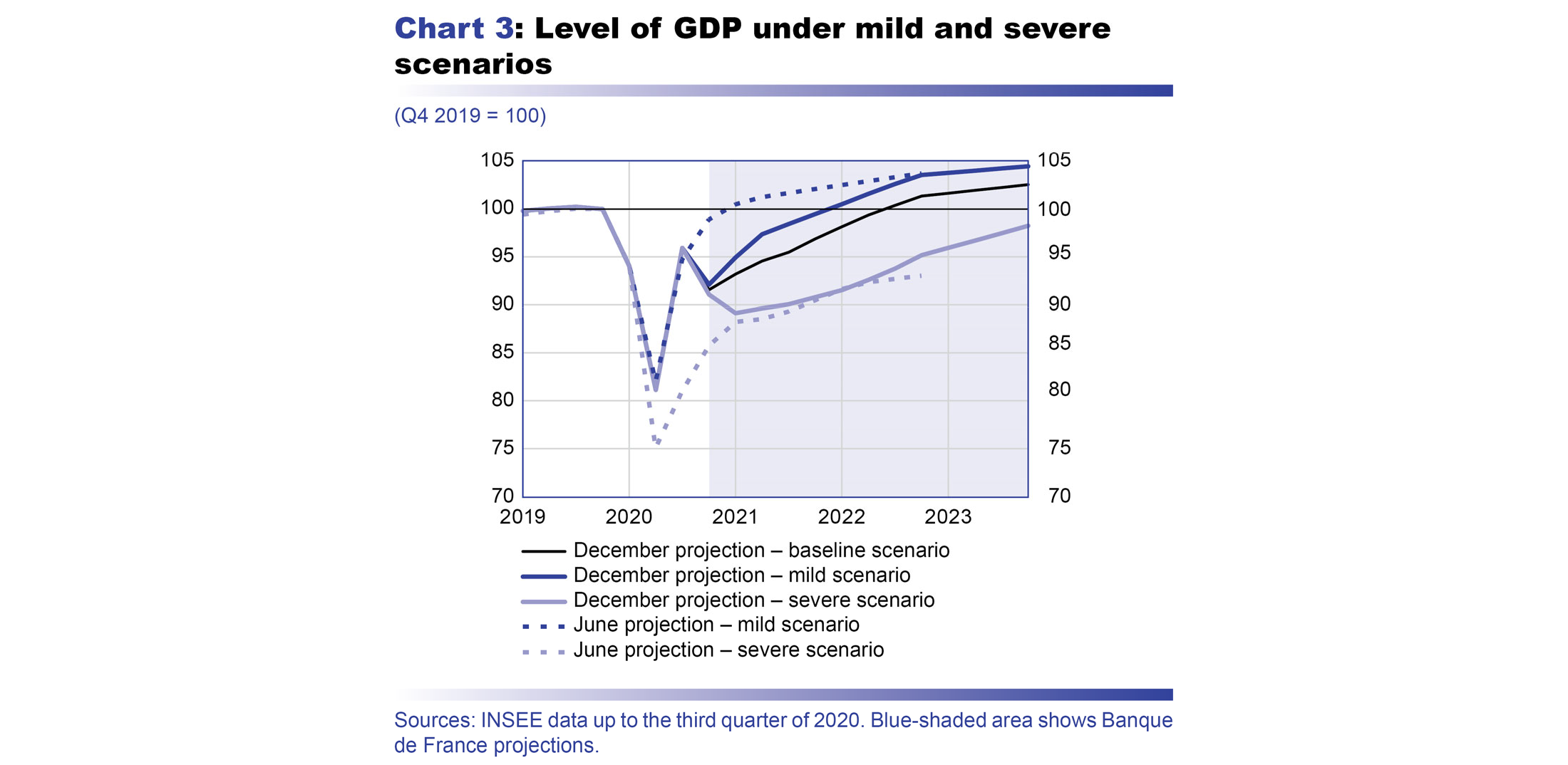

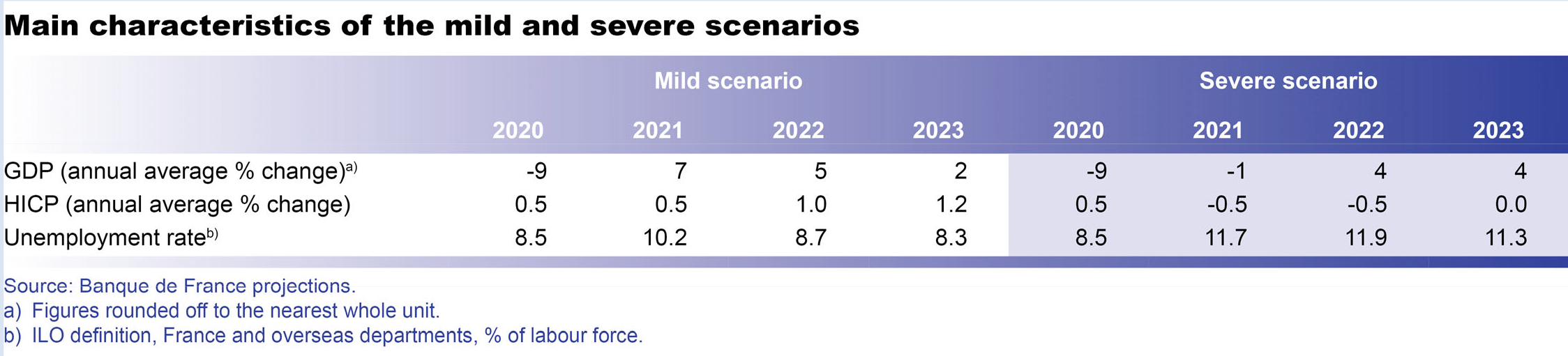

Due to the Covid-19 epidemic, our baseline scenario is subject to a much higher degree of uncertainty than under normal circumstances. This box therefore presents two alternative scenarios to our baseline projection, reflecting “mild” and “severe” dynamics in the pandemic’s development (see Chart 3). These alternative scenarios result from simulations performed using our FR-BDF projection model and constructed based on a combination of scenario-specific shocks to domestic and foreign demand, and alternative assumptions for certain financial variables. As was the case in June, these scenarios were developed within the framework of the Eurosystem’s preparation of its joint projections in December 2020 and are thus based on a coordinated approach, with the European Central Bank and national central banks publishing analogous scenarios.

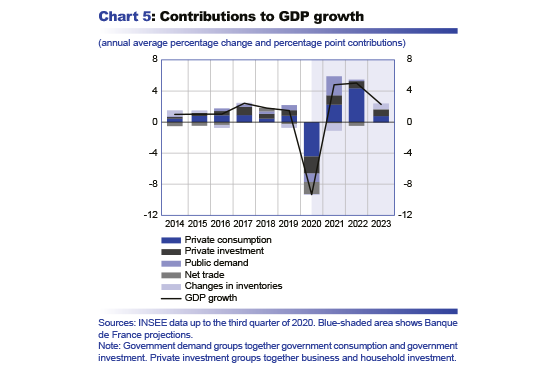

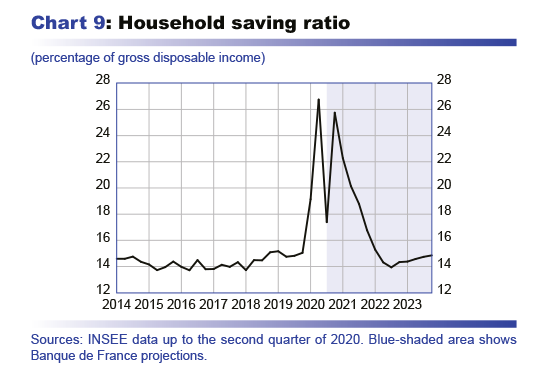

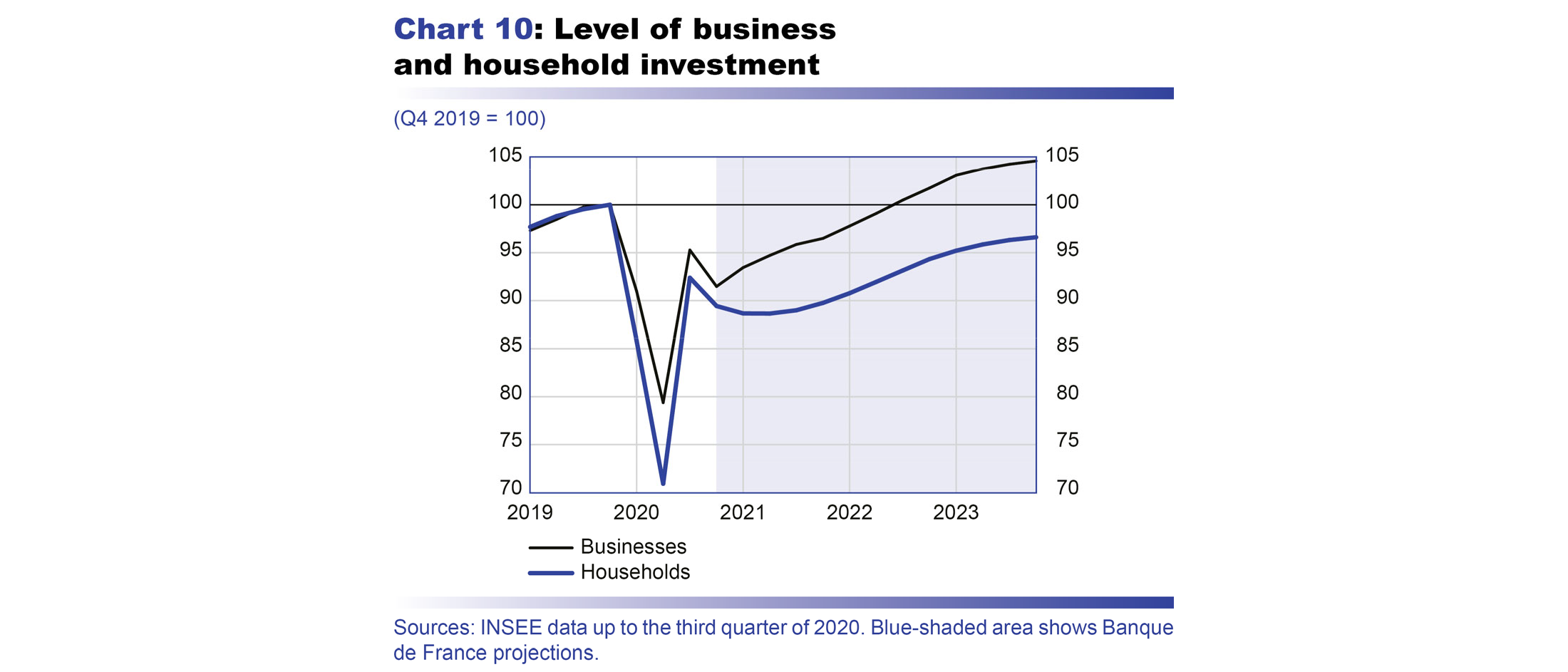

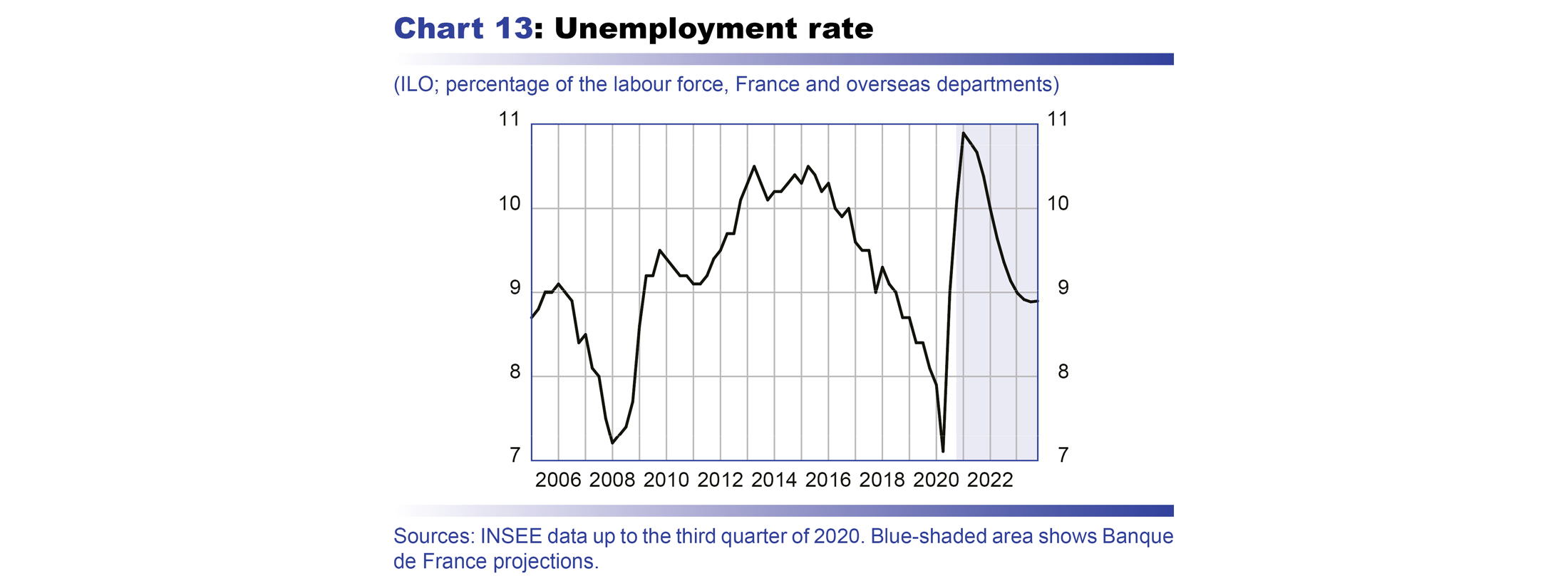

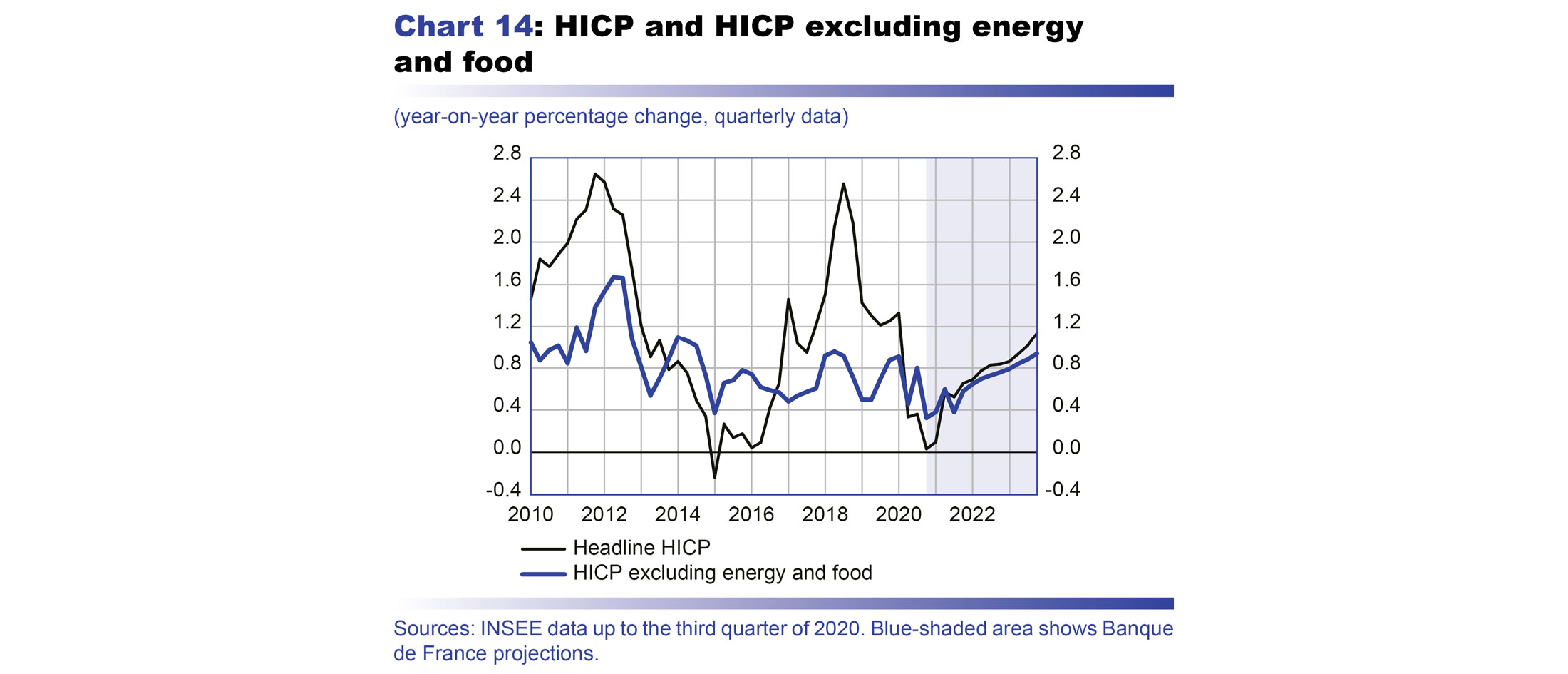

In the mild scenario, we assume that the public health situation worldwide improves rapidly and markedly from the beginning of 2021. We also assume that an effective medical solution, such as a marketed vaccine, is put in place in early 2021 and is deployed fairly rapidly and extensively throughout the year. This scenario would lead to a sharp recovery in activity both in France and internationally. In response to the success of the public health measures, which would lead to a more rapid lifting of restrictions and reduced uncertainty, households would quickly and significantly increase their spending and thus bring down the household saving ratio, while the outlook for investment would brighten considerably. Thus, after deteriorating at the end of 2020, the economy would follow a “W-shaped” recovery and GDP would return to its pre-crisis level by the end of 2021. After a still sharp decline in 2020, the rebound in 2021 and 2022 would be robust at 7% and then 5% (see table below). In this scenario, we consider that the pandemic would not have a lasting impact on potential GDP and inflation would pick up a little more markedly from its very low level in 2020, rising to 1.2% at the end of 2023. Consequently, government debt would slowly drop back over the projection horizon to a level close to 110% of GDP in 2023.

…/…

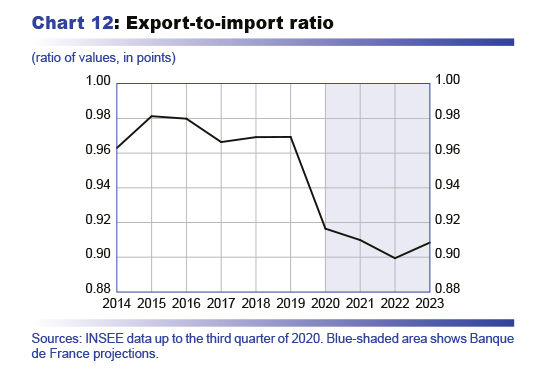

In the severe scenario, we assume that the virus continues to circulate in France and around the world with a high degree of virulence in 2021 and 2022. Strict public health measures continue to be needed, some of which remain in place until the beginning of 2023. Despite initial successes on vaccines, we assume that their widespread deployment is ultimately slow and does not reach the coverage required before the beginning of 2023. After the sharp fall in GDP in 2020, repeated or extended lockdowns and heightened economic uncertainty would continue to weigh on household and business spending and would lead to a further deterioration during the first half of 2021. In addition, with businesses failing in greater numbers in 2021, the economy’s capacity to recover would be impeded, leading to a significant loss of potential GDP. In this scenario, activity would not pick up in 2021 and would decline by 1%. Furthermore, the recovery in 2022 would continue to be gradual and restricted by long-term disruptions in the value chains and a high degree of economic uncertainty. Due to the very lasting reduction in economic activity, inflation would become negative in 2021 and 2022. Deflationary pressures would win out despite downward nominal wage and price rigidities. Consequently, government debt would exceed 130% of GDP as from 2021 and would rise sharply to a level close to 140% of GDP in 2023.

Compared to our June projections, our two alternative scenarios adhere a little more closely to our baseline scenario. This is linked to reduced uncertainty related to the economy’s short-term dynamics, which reflects a learning process since last May with regard to the understanding of the effects of public health measures on the economy, at least in the short term.