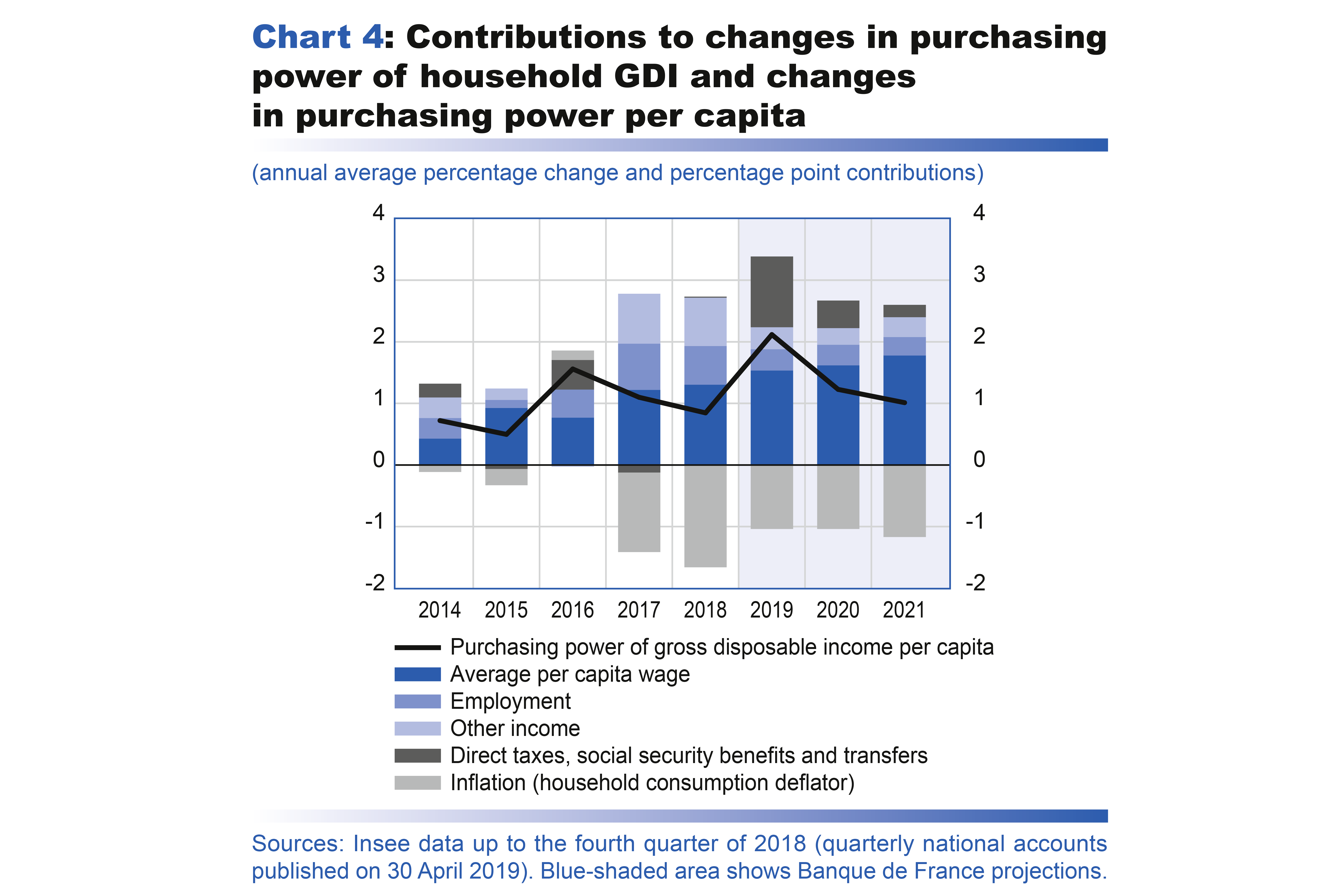

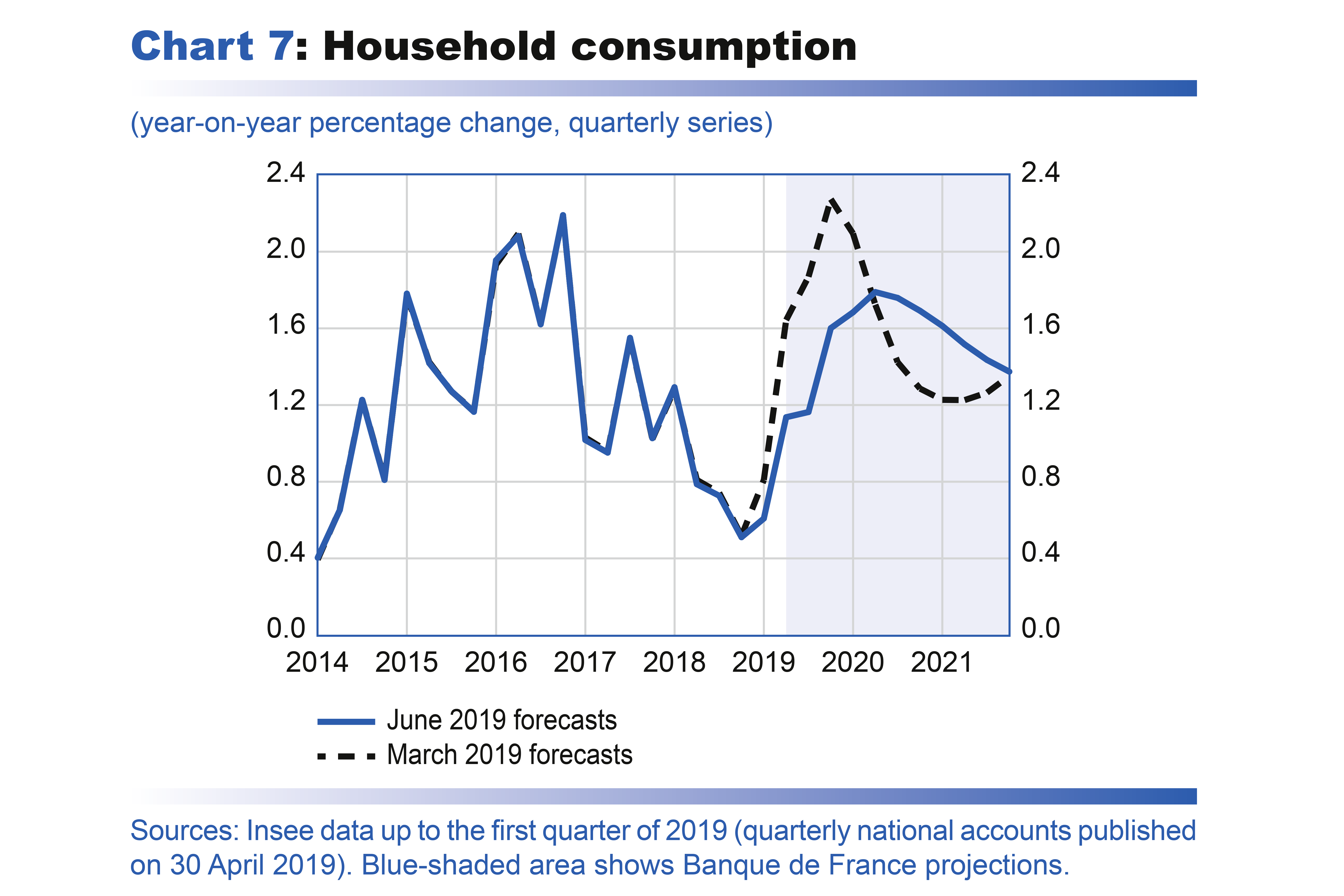

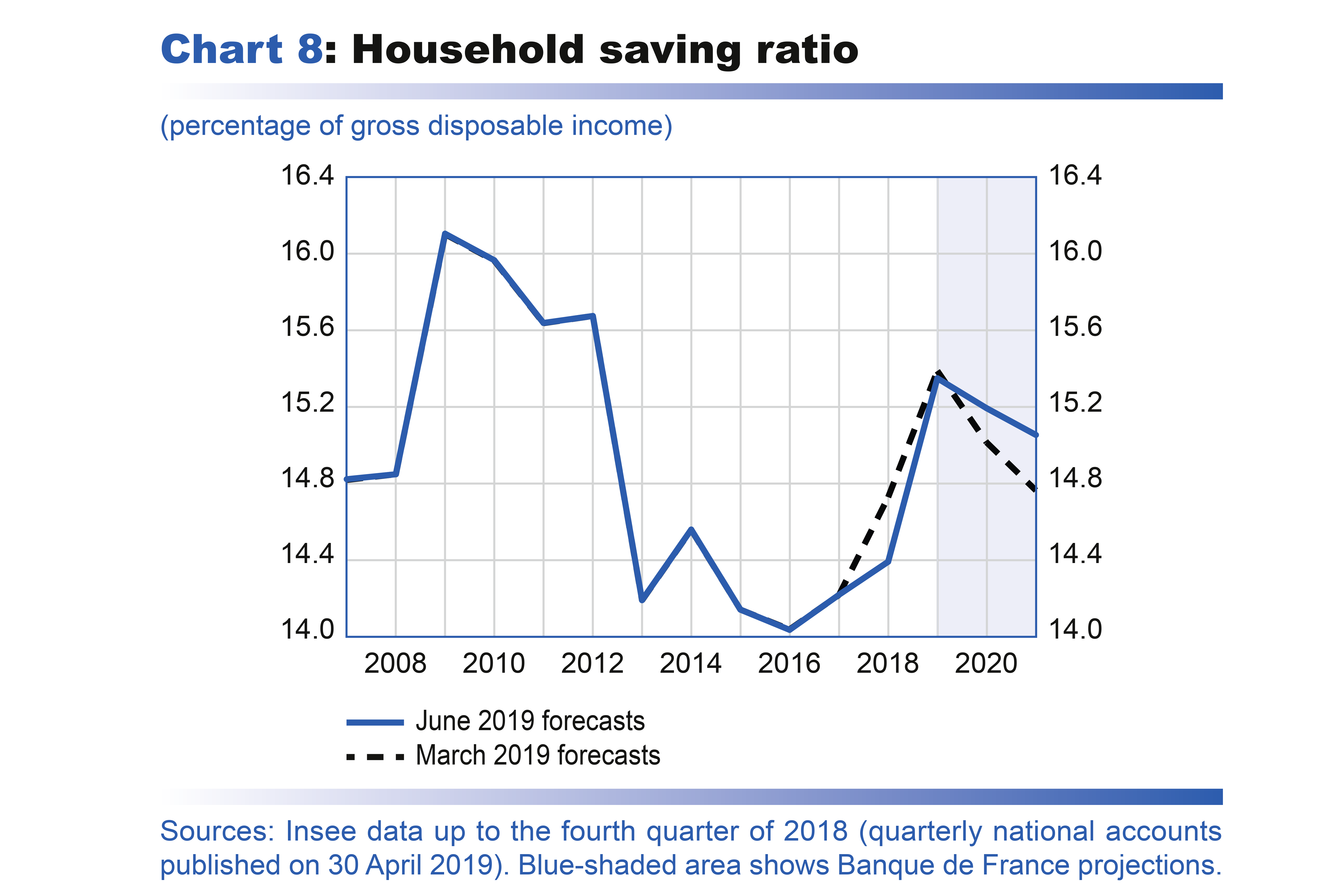

Usual empirical estimates show that purchasing power gains are initially smoothed by an increase in household savings since these agents do not immediately adjust their level of consumption. Indeed, the household saving ratio rose sharply in the fourth quarter of 2018 and even further in the first quarter of 2019 on the back of the strong gains in purchasing power observed at the end of 2018 and in early 2019. Overall, in 2019, this ratio is expected to increase greatly, before returning to levels closer to historical averages in 2020 and 2021 in our projection, as these purchasing power gains are gradually consumed.

It is nevertheless not easy to estimate the level at which the saving ratio will stand at the end of the projection horizon.

In the September 2018 macroeconomic projections , in a box entitled “The composition of household income, the household saving ratio and household consumption”, it was explained that when describing changes in the saving ratio over recent years, it is useful to consider the composition of household income (wages, social security benefits, direct taxes and social security contributions, financial income, etc.), which is a key determinant of the household saving ratio. According to this analysis, households have an intermediate propensity to consume a tax cut: on average, about half is saved and half consumed. Following this rationale, the cuts in taxes and social security contributions in recent times should result in a rise in the saving ratio in the medium term compared with its 2017 level. Hence, the saving ratio could converge towards a midway level between its 2009-10 peak and its 2015-16 trough, consistent with our forecast of the share of direct taxes and social security contributions in household gross disposable income, which is also expected to return to a midway level.

This “average-based” forecast may admittedly be affected by the distribution of tax cuts by income levels. For example, we could assume that the abolition of housing tax or the increase in the activity bonus for the most modest households have a higher propensity to be consumed. But the capital income tax cuts implemented in 2018 are likely to lead to a permanent rise in the saving ratio. Moreover, other factors play a role in the structure of household income. In particular, the sharp increase in financial income observed in 2018 also drives up the average saving ratio. Overall, the upside and downside risks surrounding our saving ratio scenario appear to be balanced.