Note: The appendices refer only to the conventional scenario.

The war in Ukraine is a major geopolitical event that will weigh on current and future macroeconomic developments in France and the euro area. Its repercussions will affect inflation – almost immediately via a rise in the price of energy and other commodities – as well as growth. The uncertainty surrounding future developments, including in the very short term, is also very high.

In this context, the macroeconomic scenarios for France are based on our current assessment of the different channels through which the crisis will be transmitted to the economy, even though their relative intensity is likely to evolve over coming weeks and months. We are focusing on three main channels for the construction of both our scenarios. The “conventional” scenario is based on assumptions with a cut-off date of 28 February (see Table A in the appendix), in line with the Eurosystem’s joint projection exercise. The term “conventional” reflects the idea that it provides a snapshot at a given date (28 February 2022) in an environment that is evolving very rapidly. The alternative, or “degraded”, scenario is based on more unfavourable assumptions regarding energy prices and the uncertainty shocks that could affect the French economy. However, it does not encompass the full spectrum of possible developments, including ones that are more unfavourable. Our two projections do not therefore represent a “range” but rather describe two possible trajectories.

The first channel of transmission, and probably the main one at this stage for the French economy, concerns commodity prices. As commodities are imported, these price rises are a drain on the national economy and have a downward impact on GDP and an upward impact on consumer prices. Under the conventional scenario, our assumptions are based on spot prices and market-traded futures contracts as at 28 February 2022, in line with the Eurosystem’s projections for the broader euro area. With regards to energy (see Table 1), the assumption is that the price of Brent oil will remain close to USD 100 a barrel between February and April 2022, before falling back again gradually (to USD 86 at end-2022 and USD 75 at end-2024). Similarly, the price of natural gas per megawatt hour (European terminal) is assumed to be around EUR 107 from February to April, and then to decline (to EUR 105 at the end of 2022 and EUR 40 at the end of 2024). Over 2022, oil is seen averaging USD 93 per barrel, which is USD 15 higher than in the assumptions underlying our December 2021 projection.

That said, commodity prices are very volatile at the moment and have continued to rise since 28 February. Under the degraded scenario, we assume that the price of oil will be USD 125 a barrel and the price of natural gas EUR 200 per megawatt hour until 2024 (see Table 1). This scenario therefore differs not only in terms of the size of the shock at the start of the projection, but also in terms of its duration as futures prices for oil and gas are currently factoring in a marked reversal by 2024.

The war in Ukraine is not only affecting energy prices but also those of a series of commodities. Our degraded scenario notably factors in the impact on food prices of a rise of around 65% in the price of wheat compared with end-February.

Regarding energy, we cannot of course rule out a propagation of the shock via quantities and not just via prices, with a possible rationing of supplies in Europe. This clearly identified risk is very difficult to quantify; as a result we have not incorporated it into either of our scenarios – beyond what is already anticipated by the markets via the rise in prices – but it represents a significant downside risk to both.

The second channel we examine is financial tensions and, more generally, the uncertainty weighing on investment and consumption. Under the conventional scenario, we assume that this channel will contribute to a reduction in French GDP of around half a percentage point in total over the second and third quarters of 2022 combined, in line with the volatility observed in the markets at the start of March. Under the degraded scenario, we assume that this volatility will intensify further and shave another half a percentage point off GDP in 2022-23. As for the influence of financial markets, the intensity of this channel will largely depend on whether the tensions prove to be localised or global, and on how long they last.

The third and final channel is external trade. Excluding commodity imports, the value of France’s direct trade with Ukraine and Russia is low. However, shocks to commodity prices or to uncertainty will affect all economies, especially those in Europe. As a result, under the conventional scenario, foreign demand for French goods and services is expected to be around 0.5 percentage point lower in 2022 than we anticipated in mid-February. Under the degraded scenario, as neighbouring countries experience the same shock, foreign demand for French goods and services is projected to be reduced by an additional 1.4 percentage points.

Beyond the external demand channel, economies are also likely to be affected by disruptions to supply chains. Some firms are starting to experience input shortages, forcing them to shut down activity for shorter or longer periods. The Covid pandemic and subsequent emergence from this crisis underlined the importance of this channel, but also showed that firms are capable of gradually adapting. The impact is difficult to quantify at this stage, however, and remains an additional risk to both our scenarios.

The geopolitical shock is weighing on a recovery dynamic that was looking strong, in spite of the obstacles linked to the pandemic or supply constraints. Indeed, these obstacles were probably beginning to dissipate gradually, as shown by the improvement in public health indicators these past weeks and the slight easing of supply bottlenecks reported by businesses. Business surveys in recent months and at the start of March suggest that GDP growth could be around ½% in the first quarter of this year, which is higher than we anticipated in December. This rate of growth should still be reached in the first quarter, provided that activity continues to hold up on the whole in March. As a result, our baseline scenario before the outbreak of war in Ukraine was for GDP to expand by 3.9% in 2022, compared with a forecast of 3.6% in our December publication, thanks to the growth carry-over at the end of 2021 which had also been revised upwards (to 2.4%).

Under both our scenarios, the consequences of the Ukraine conflict on French activity should start to be felt as of the second quarter of 2022. The change in GDP should only be slightly positive up to the autumn under the conventional scenario, and even slightly negative under the degraded scenario. All components of demand are expected to be affected to varying degrees: household consumption should slow due to the impact of energy prices on purchasing power; the increased uncertainty over the future should hamper investment; and the negative impact on global trade should also hurt French exports.

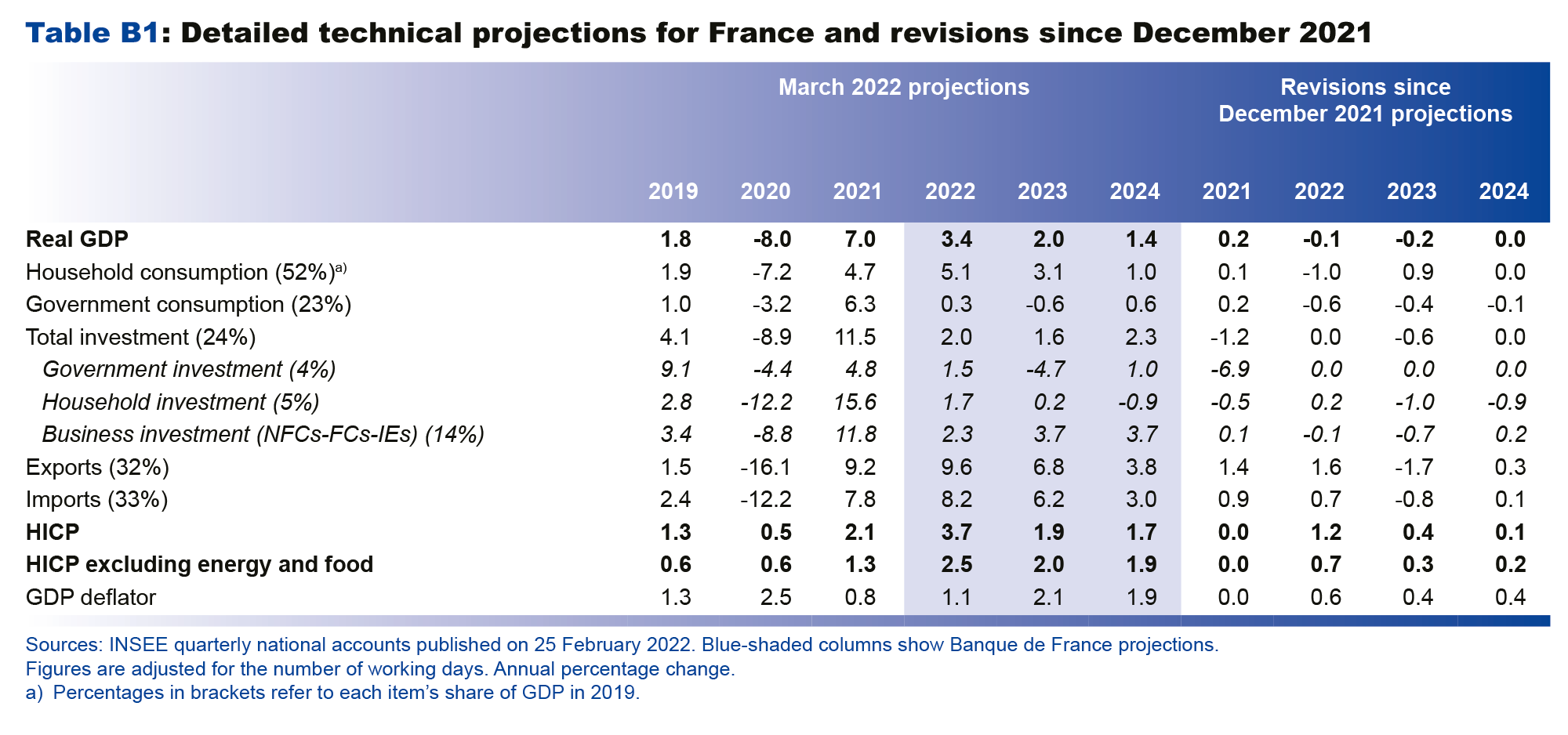

Over the full year 2022, GDP is seen growing by 3.4% under the conventional scenario, and by 2.8% under the degraded scenario. However, these high annual average growth rates, even under the degraded scenario, mask feeble rates of expected growth over the coming quarters. Given the resilience of activity identified in our business surveys since the start of the year, the growth carry-over for 2022 is estimated at 2.9% at the end of the first quarter. The slowdown is more visible in the year-in year growth rate: between the end of 2021 and end of 2022, GDP should only expand by 0.8% under the degraded scenario, compared with a projected rise of 1.8% under the conventional scenario and 2.4% in our December forecast.

In 2023, GDP is projected to grow by 2.0% under the conventional scenario, which assumes that the reversal of energy prices in particular will allow the economy to return to near its pre-crisis dynamics, as anticipated in December (see Chart 1). Under the degraded scenario, where the initial shock has more lasting repercussions and where energy prices are assumed to stay higher for longer, the shock should continue to be felt, with growth of just 1.3% and activity levels well below pre-crisis trends.

For 2024, the two scenarios should continue to differ, especially regarding the level of activity (see Chart 1). Under the conventional scenario, activity is seen growing at close to the usual rates for the French economy (1.4%), in line with the assumption of a return to potential GDP. Under the degraded scenario, however, growth in 2024 should be slightly weaker: the financial drain caused by energy prices should continue to weigh and activity is projected to remain well below the conventional scenario level.

The upward revisions made prior to the Ukraine war combined with the first unfavourable information available at the end of February raised the hope that GDP in 2024 could return to a level close to our December forecast (see Chart 2). By contrast, the additional shocks incorporated into the degraded scenario result in a 1.7% reduction in the level of GDP in 2024.

At this stage, for our economies, the main transmission channel for the consequences of the Ukraine conflict is inflation. The inflation rate was already higher than expected (HICP inflation of 4.1% in February in France) as the post-Covid recovery has been accompanied by supply bottlenecks and especially by upward pressures on energy prices. Whereas in December we predicted that the inflation hump would gradually dissipate in 2022, the additional surge in commodity prices since end-February puts this outlook in doubt. Headline inflation is expected to remain high in 2022 and possibly in 2023 under the degraded scenario.

Under the conventional scenario, inflation as measured by the rise in the Harmonised Index of Consumer Prices (HICP) should remain close to 4% up to September (see Chart 3), and then start to ease back partially at the end of the year (a little over 3% in December). Over the full year 2022, inflation is projected to average 3.7%. In 2023 and 2024, assuming that oil and gas prices retreat markedly by then, inflation should come back to below but close to 2%.

The high inflation rate for 2022 reflects the strength of energy prices, even though their impact on retail prices should be considerably mitigated by the price shield over the course of the year. Food inflation remained moderate in February 2022 (1.7% year-on-year), but is expected to strengthen sharply in the coming months as food commodity price rises feed through to final prices, a process that can take three to four quarters. Similarly, the continuing rise in industrial producer prices suggests that manufactured goods inflation should only reach a peak after the summer. Services inflation should gradually pick up, buoyed in particular by wage growth.

Once the current very strong shock has passed, our conventional scenario, in line with our December projection, sees inflation excluding energy and food settling at close to 2% in 2024, which is higher than over the past decade, but comparable to the rates seen in the 2000s.

Under the degraded scenario, the factors at play should be the same as those described above, but their intensity is anticipated to be stronger (see Chart 3). Headline inflation is expected to be 4.4% in 2022 and should still be above 4% in the final quarter of this year. The price shield is still expected to keep it in check, however, by capping the rise in gas prices for households despite the extremely high wholesale prices. Assuming the price shield is lifted in 2023, inflation should remain high next year under the degraded scenario, at an annual average of 3.3%. It is not expected to come back under the 2% mark until the start of 2024, but should then continue to ease, falling below the trajectory seen under the conventional scenario. As oil and gas prices stabilise, even at very high levels, imported inflation should fall sharply, while inflation from domestic sources should be negatively impacted by the fact that activity is expected to remain below potential under this degraded scenario.

HICP inflation has thus been revised upwards substantially since our December projection (see Chart 4). In mid-February, even before the shock of the war in Ukraine, we were already anticipating a sizeable upward revision, especially for 2022. This has been increased under our conventional scenario, based on assumptions with a cut-off date of 28 February. Under our degraded scenario, the upward revision is even larger at 1.9 points for 2022 and 1.8 points for 2023 compared with our December projection.

The scenarios described here are expected to have concrete ramifications for households and firms. For the French economy as a whole, the sharp rises in oil and natural gas prices should be a significant drain on national income since France imports these commodities. Based on 2019 import volumes, a EUR 10 rise in the price of a barrel of oil adds around EUR 4.8 billion to the annual energy bill, while a EUR 10 rise in the price of a megawatt hour of natural gas adds around EUR 3.4 billion. France’s oil and gas bill, which should be about 2.7% of GDP in 2022 under the conventional scenario (compared with 1.9% in 2019), would thus rise to 4.5% of GDP under the degraded scenario.

This external drain on finances should affect households and firms, but also potentially general government, including via the measures it puts in place to mitigate the impact. These forecasts incorporate the measures already announced for the price shield until the end of 2022 (but not any reinforcement or possible extension in its scope or duration).

For firms, the shock to input prices is expected to erode profitability. The non-financial corporation (NFC) margin rate in 2022 should therefore be much lower than before the crisis, including under the conventional scenario, although in 2021 it reached a historical high, helped by the recovery plan and especially the cut to production taxes. With activity also expected to lose momentum in the coming quarters, business investment growth should slow markedly in 2022 (2.3% under the conventional scenario and –0.5% under the degraded scenario, after a rise of nearly 12% in 2021).

For households, the inflation shock should weigh temporarily on purchasing power per capita in 2022, after the sharp rise seen in 2021 (2.0% growth in annual average terms). The impact is expected to be weak under the conventional scenario, but more marked under the degraded scenario, although the size will also depend on any additional measures the government might take on top of the current price shield. Certain mechanisms are expected to buoy nominal income, such as the indexation of the minimum wage and the fact that the improvement seen up to now in the labour market should support wage growth in 2022, as demonstrated by recent wage negotiations in some sectors. That said, after the recent positive surprise in job figures, employment could lose momentum. These scenarios do not take account of the cushioning role that could be played by a reinstatement of the short-time work schemes.

This limited fall in purchasing power in 2022 should partially affect consumption. However, the annual figures are hard to interpret. Indeed, household consumption is expected to rise by 5.1% in annual average terms in 2022 under the conventional scenario, and by 4.3% even under the degraded scenario. But these annual averages largely reflect the catch-up effect seen over the start of 2022 as behaviours adapted to the pandemic situation. At the aggregate level, households do indeed have a very large financial savings surplus (EUR 175 billion) that can help to cushion this shock. However, this effect could be dampened by the uncertainty, which will probably prompt consumers to adopt a wait-and-see approach. In addition, many low-income households do not have sufficient savings to absorb the shock.

Beyond 2022, the pace of normalisation differs under the two scenarios. Under the conventional scenario, the fall in inflation in 2023-24 should lead to an improvement in purchasing power and corporate margins. This is expected to support the rebound in activity, and should notably contribute to a re-acceleration in business investment in 2023, which should then be confirmed in 2024. In the degraded scenario, by contrast, real household and corporate incomes are seen rising only slightly in 2023, which should continue to weigh on rates of growth in their consumption and investment spending.

The scenarios presented here do not cover all possible future outcomes: the geopolitical situation surrounding the war in Ukraine is highly unstable and shifting, with a risk of developments that could have more or less severe impacts on Europe. A stoppage of energy imports from Russia would probably have greater economic consequences, but these are hard to quantify at this stage. It could notably fuel an even stronger spike in inflation than anticipated here, or even a global economic and financial crisis. Conversely, any easing of the geopolitical situation, even a partial and gradual one, would have positive effects on activity and put downward pressure on inflation. As a result, the scenarios presented here do not represent a range of forecasts but rather two possible trajectories.

In addition, these scenarios do not take into account the economic policy responses that could be implemented at the national and European levels, which would mitigate the macroeconomic impact of the shock or spread out the effects over time. These scenarios were notably finalised on 7 March and hence do not incorporate the resilience plan or the conclusions of the European summit in Versailles.

Beyond the consequences of the war in Ukraine, the epidemiological situation appears to be improving with the gradual lifting of restrictions in Europe. However, the experience of the past two years shows that we cannot rule out the emergence of a new variant of the virus.

Note: The appendices refer only to the conventional scenario.