Economic projections Macroeconomic projections – September 2022

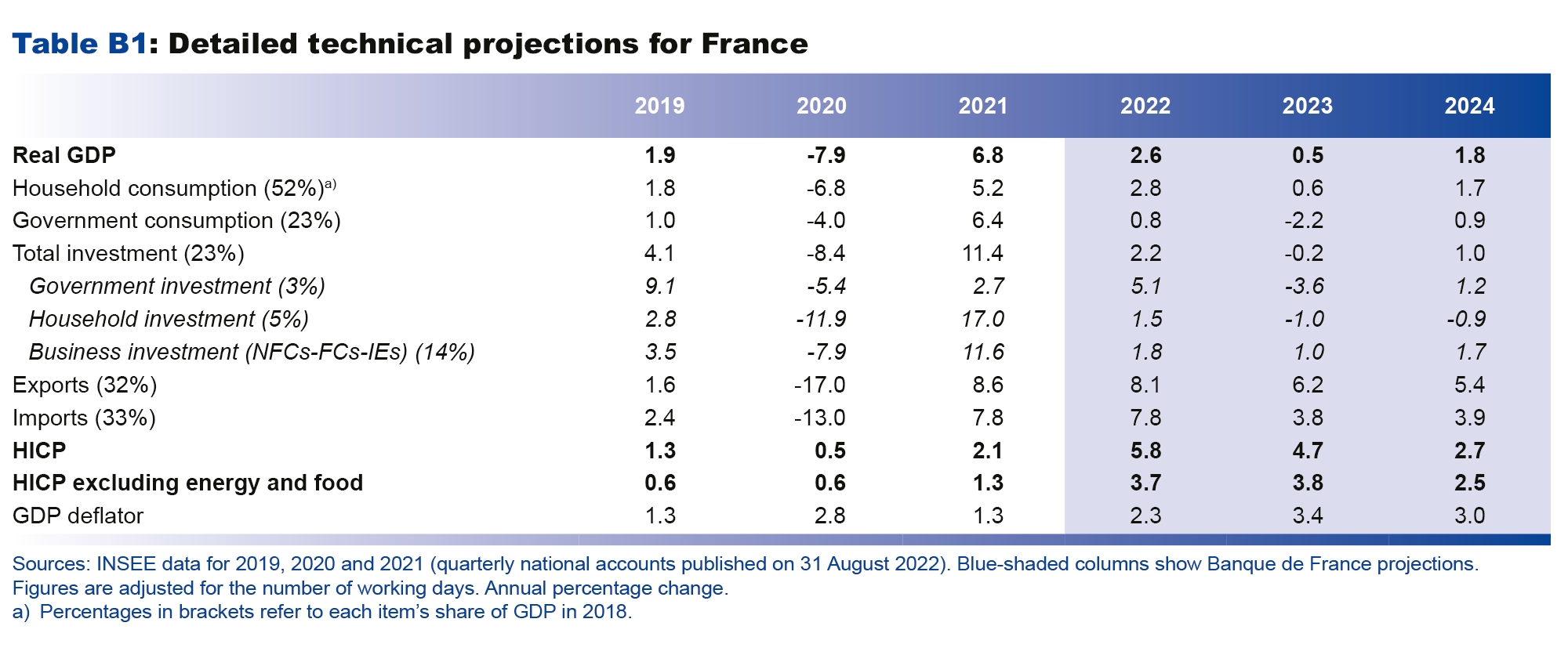

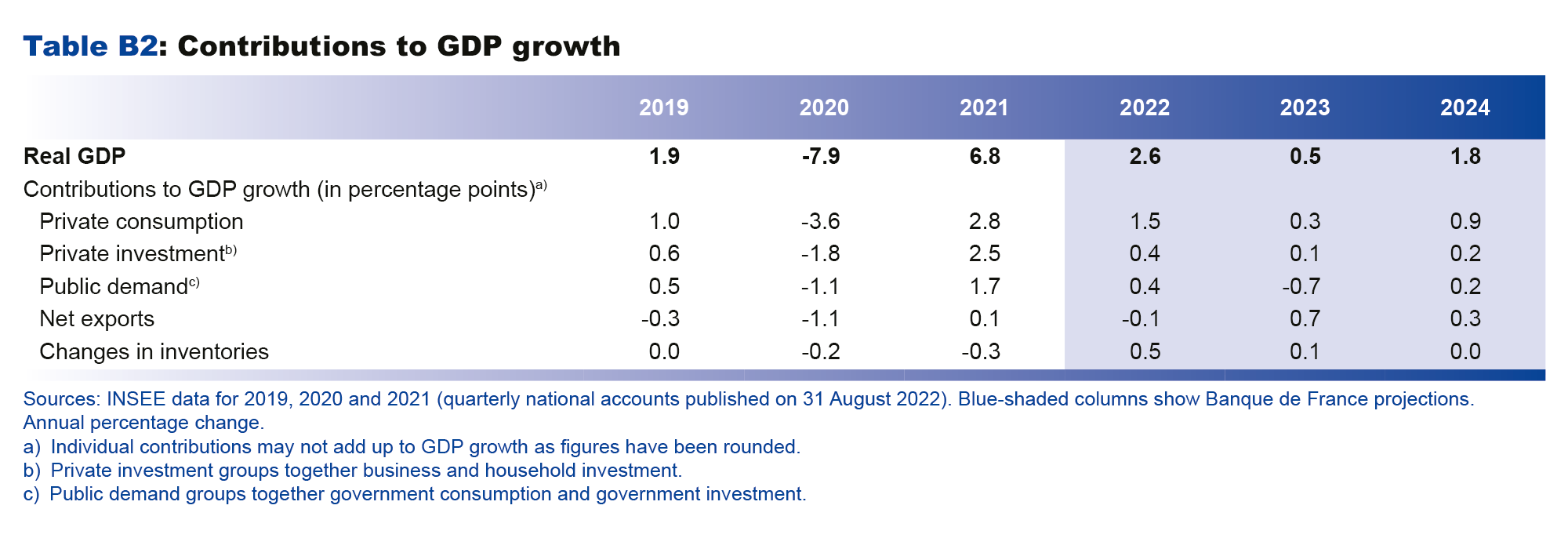

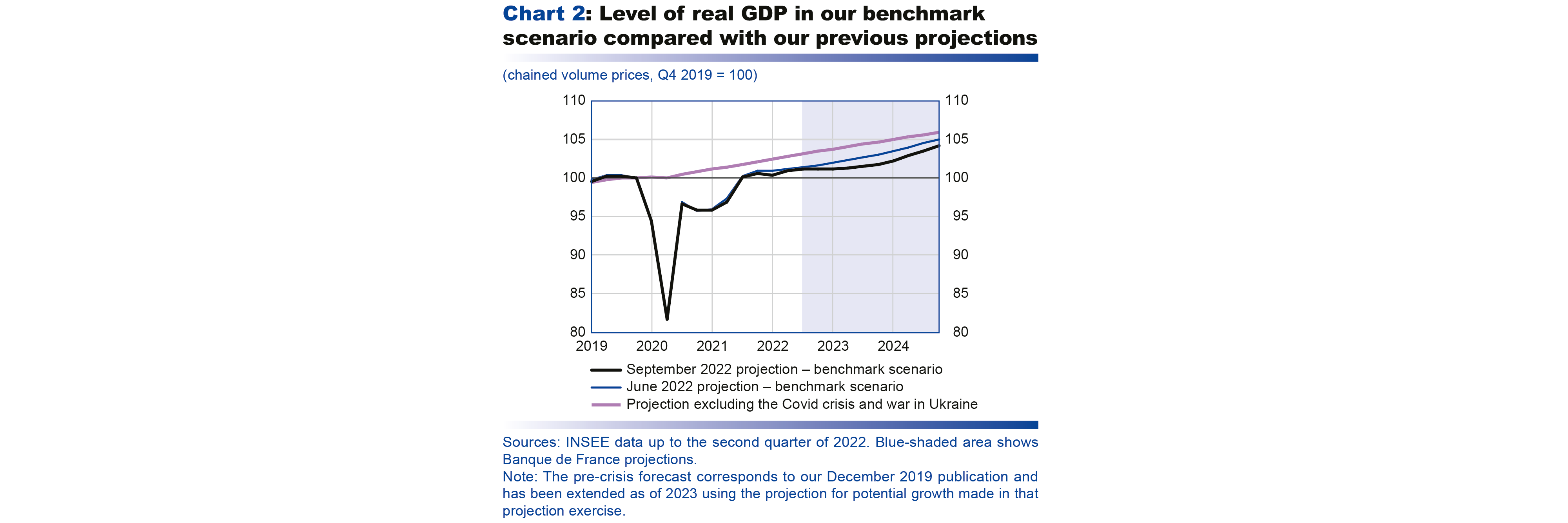

▪ Over our projection horizon, the French economy is expected to go through three very distinct phases: better-than-expected resilience over the majority of 2022; a sharp slowdown as of this winter, the size of which is subject to major uncertainty; and a return to economic expansion in 2024.

▪ Despite persistent supply-side difficulties, GDP growth should be stronger than previously expected in 2022 (annual average of 2.6%) thanks to resilient demand and to the rebound in the services sector. But the additional shock to European natural gas prices over the summer, coupled with Russia’s shutdown of gas deliveries to Europe, should drag on activity as of the final quarter.

▪ For 2023, the projections are shrouded in significant uncertainty linked to how Russia’s war in Ukraine unfolds. The risks relate to the quantity and price of gas supplies, and to the scale and duration of the government measures to cushion households and businesses. As a result, we have chosen to provide a range of forecasts. The annual change in GDP is anticipated to be between 0.8% and -0.5%, with inflation ranging from 4.2% to 6.9% respectively. These ranges have been constructed around a benchmark scenario whereby, according to convention, energy prices (oil and gas) are expected to follow futures prices (as observed on 22 August), and the shutdown of Russian gas deliveries should be partly offset by the availability of alternative sources and by energy savings. Under this benchmark scenario, electricity prices are projected to follow a similar path to that observed in 2022, while gas prices are seen adjusting gradually and coming back to levels justified by market prices by mid-2024. This should result in GDP growth of 0.5% in 2023, and (HICP) inflation of 4.7% along with the preservation of purchasing power per capita. GDP growth should reach the top end of the forecast range if the adjustment of gas prices proves more limited thanks to a more gradual lifting of the price shield, although the trade-off for this would be a sharper rise in government debt. Conversely, the bottom end of the forecast range – where we cannot rule out a recession, albeit a limited and temporary one – corresponds to a scenario where the shutdown of gas deliveries is accompanied by an additional rise in natural gas prices and a limitation of gas and electricity supplies to end-users.

▪ In 2024, as tensions in energy markets gradually dissipate, the French economy should see a return to more robust growth. Under our benchmark scenario, GDP is projected to rise by 1.8% in 2024 and headline inflation should return towards the 2% target by the end of the year (annual average rate of 2.7%).

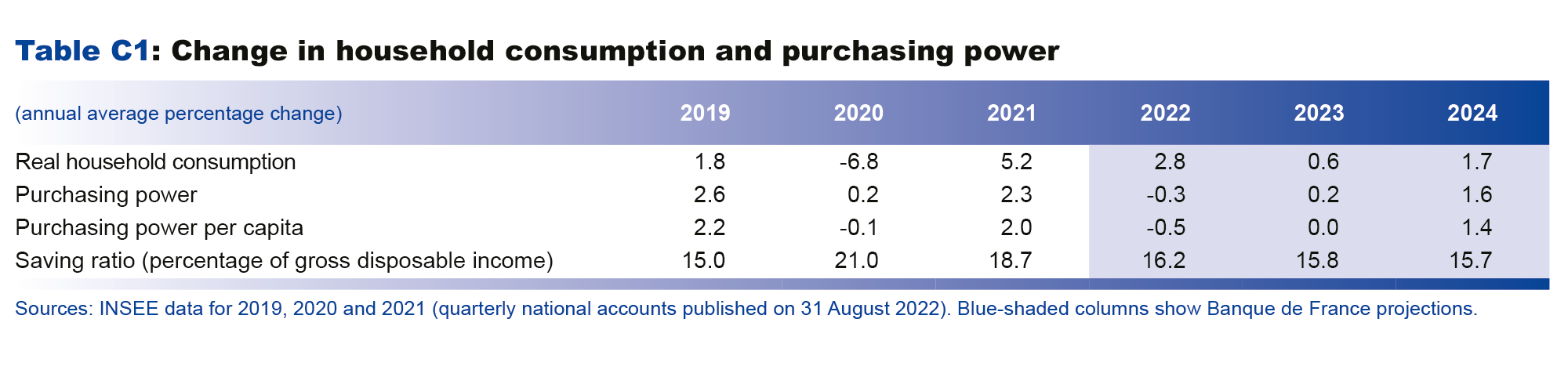

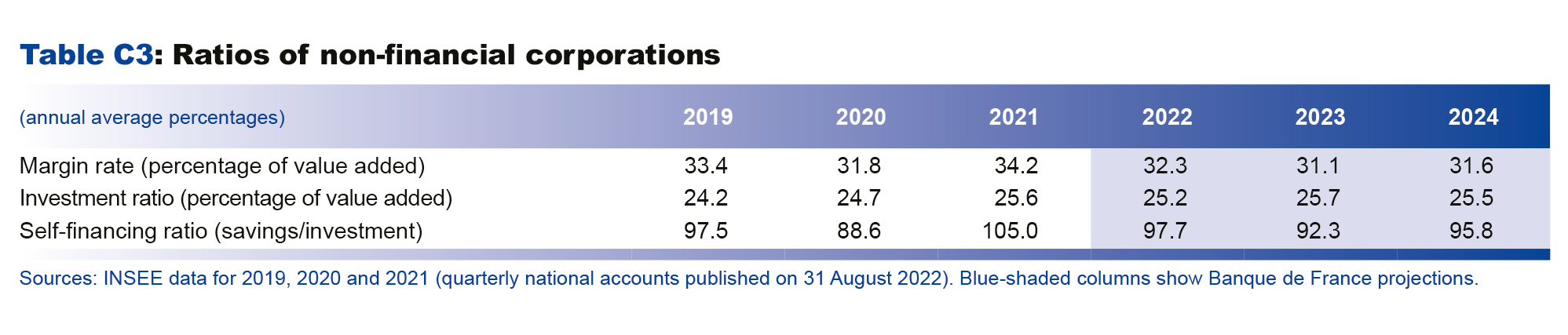

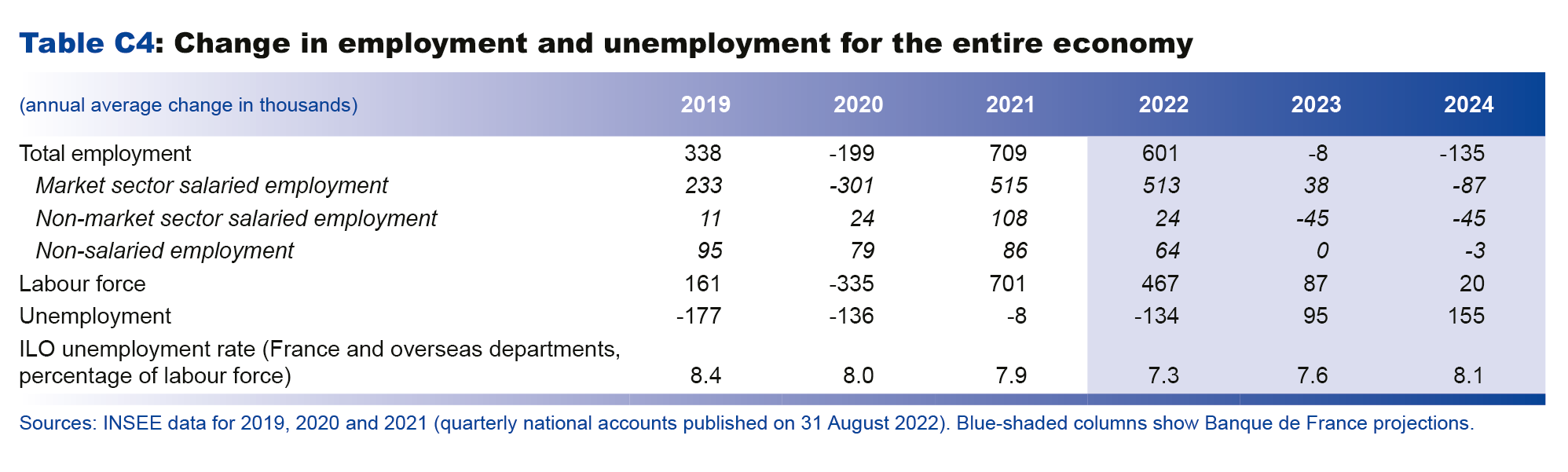

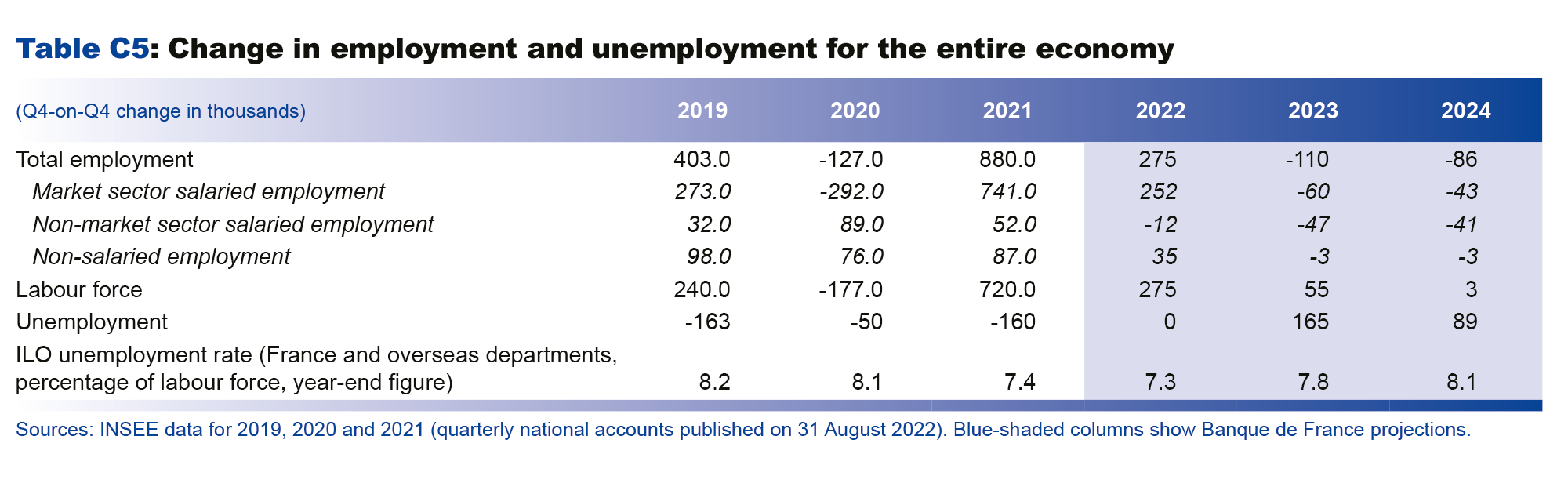

▪ Over the three years, employment, household purchasing power and corporate margin rates should all prove resilient in the French economy: despite short-term fluctuations, each of these three variables is anticipated to be higher in 2024 than pre-Covid levels. In contrast, the government debt ratio, which has already increased sharply as a result of the Covid shock, is not predicted to decrease by 2024, notably due to support measures such as the price shield.

Owing to the strong uncertainty, especially related to gas prices and supplies, and to the price capping measures used to cushion the blow, we are providing a range of forecasts for 2023

Our benchmark scenario incorporates the following conventional assumptions:

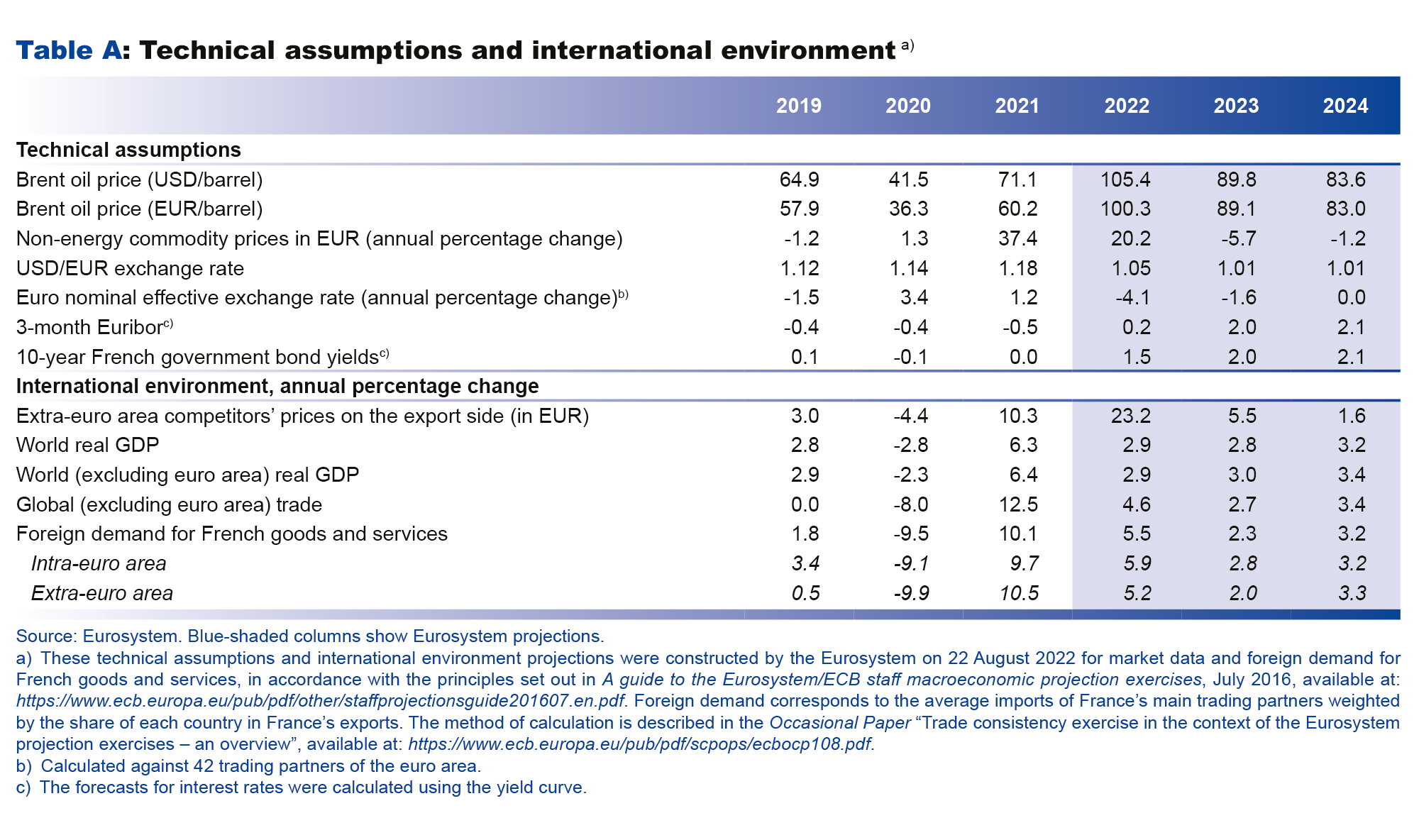

· In accordance with Eurosystem conventions, price trajectories for crude oil and natural gas that are in line with their respective futures curves as observed at 22 August 2022: for (brent) crude, this is similar to the path predicted in June, with the price per barrel seen falling from USD 105 in 2022 to USD 84 in 2024; however, for natural gas the path has been revised upwards significantly, with the TTF price now seen reaching EUR 235/MWh in 2023 before subsiding to EUR 168/MWh in 2024.

· A complete stoppage of imports of Russian gas, but with no significant rationing under the benchmark scenario thanks to alternative sources and possible energy savings. The latter should be equivalent to around a quarter of France’s Russian gas imports prior to the Ukraine conflict.

· A gradual lifting of the price shield, with consumer gas prices converging towards theoretical regulated sale prices (calculated based on wholesale futures prices as at 22 August) by mid-2024 (see Chart 1).

As detailed below, these assumptions lead to a marked deceleration in GDP growth to 0.5% in 2023, and to persistently high inflation with a headline HICP (Harmonised Index of Consumer Prices) rate of 4.7% (and HICP inflation excluding energy and food of 3.8%).

These benchmark projections were constructed before the government’s 14 September indications on the draft 2023 Budget Law and the price shield, with which they nonetheless appear to be compatible. They take into account the measures already voted into law and known at the start of September, which is the cut-off date for our projections (including the emergency measures to protect purchasing power, the amended Budget Law for 2022 and the 2022-27 Stability Programme). On this basis, the government debt-to-GDP ratio is at best projected to remain stable between 2021 and 2024.

As the uncertainty surrounding these assumptions is particularly high, we have chosen to provide a range of forecasts for 2023, from 0.8% to -0.5% for the annual change in GDP, and from 4.2% to 6.9% for inflation.

The upper end of this range corresponds to the assumption that the price shield will be lifted even more gradually, leading consumer gas prices to converge towards regulated prices just beyond our projection horizon (first quarter of 2025). This would be accompanied by a sharp increase in government debt.

Conversely, the bottom end of the forecast range reflects the materialisation of a combination of downside risks:

· An additional rise in the TTF gas price (to EUR 360/MWh in 2023 according to alternative Eurosystem assumptions) coupled with a limitation of supplies to end-users due to the availability of fewer alternative sources. Given the extent of this extra rise, it would not be cushioned by the price shield.

· A risk that the nuclear reactors currently closed due to corrosion problems might remain offline, which would limit electricity output in France in the first quarter of 2023 and could lead to supply difficulties in the event of a harsh winter.

· Increased uncertainty as a result of these shocks, which would weigh on household consumption and business investment

With Russia’s war in Ukraine, activity in 2022-24 should follow a cycle of Resilience-Slowdown-Recovery

These projections incorporate the detailed national accounts for the second quarter of 2022 published by INSEE on 31 August 2022, and the economic data from the Banque de France’s third quarter business surveys. They also take into account the Eurosystem’s technical assumptions, for which the cut-off date is 22 August 2022.

With certain sectors benefiting from the lifting of the last public health restrictions – especially services, notably with the rebound in tourism – GDP expanded by 0.5% in the second quarter of 2022 after contracting by 0.2% in the first quarter. According to the Banque de France’s business surveys, activity should continue to hold up in the third quarter, with growth of 0.3% fuelled by the observed strength in services. Annual GDP growth should therefore prove robust again in 2022, at 2.6% in average terms, reflecting a significant carry-over effect from the sharp recovery in the second half of 2021.

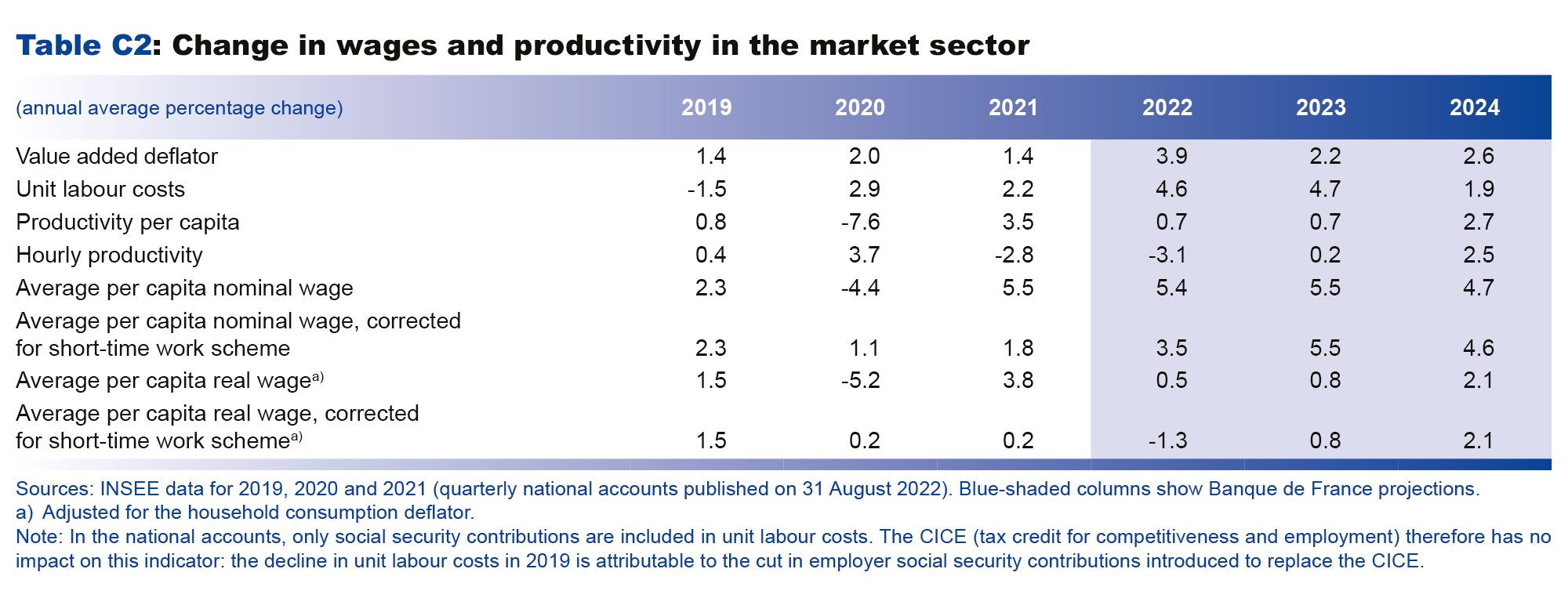

However, the continuing strong pressures in energy markets, and especially in gas markets, will lead to a further increase in the external levy on businesses, households and the state, which was already more than two percentage points of GDP in the second quarter of 2022 (this represents the contribution of energy prices to the deterioration in the trade balance since 2019). The downward pressure on corporate margins in 2023 should only be partially mitigated by fiscal support measures, including the gradual abolishment of the cotisation sur la valeur ajoutée des entreprises (CVAE – company value-added contribution). But the reduction should only be temporary, and margin rates are expected to hold up well over the projection horizon, exceeding their pre-crisis 2018 level in 2024 (2019 was impacted by the double-counting effect of the Tax Credit for Competitiveness and Employment or CICE). After declining slightly in 2022, average household purchasing power is expected to stabilise in 2023 thanks to the government support measures, and then to increase again markedly in 2024.

Under our benchmark scenario, therefore, activity growth is projected to be close to zero in the final quarter of 2022 and first quarter of 2023, in other words over the winter when the situation in the gas markets could be at its most critical. GDP growth should remain weak over a large part of 2023 (see Chart 2), and average 0.5% over the full year. The phase of economic expansion should return in 2024, once the pressures on commodity prices and energy supplies have passed their peak, taking GDP growth to 1.8% in 2024.

Inflation should peak by the start of 2023 amid persistent energy price pressures, but should then decline towards 2% by the end of 2024

Inflation as measured by the Harmonised Index of Consumer Prices (HICP) has continued to strengthen in recent months, reaching 6.6% in August (see Chart 3 below). While this high rate is mainly a direct result of energy prices, the rise in which has been exacerbated by the war in Ukraine, the other components of inflation are also increasing (see Chart 4). This is largely due to the pass-through of energy prices to the other components of the HICP (which is fairly rapid in the case of manufactured goods, food and transport services, and more gradual for other services). In July, services inflation proved strong (at 4.3% year-on-year, following 3.4% in June), buoyed by the start of the summer tourist season. Food and manufactured goods inflation was driven further upwards by the lagged pass‑through of the production cost rises observed in the first half of 2022.

In 2022, headline inflation is expected to come out at 5.8% in annual average terms (and underlying inflation at 3.7%). The recent surge in European gas prices is a new inflationary shock to the French economy and should last for the coming quarters. For the time being it is not expected to directly affect retail prices due to the price shield on gas and electricity, and to the extension and increase of the rebate on fuel prices until the end of the year. However, the gas price shock should indirectly affect food and manufactured goods inflation via the rise in businesses’ production costs. On top of that, the ongoing talks between producers and distributors in the agri-food industry have already led to substantial price rises, and these should be passed on at least partially to consumers. Last, services inflation is expected to be supported by strong wage growth, reflecting the upward revision of the minimum wage and industry-level negotiated pay rises.

In 2023, under our benchmark scenario, headline inflation is seen averaging 4.7% over the year, with underlying inflation remaining relatively stable at 3.8%. With the gradual reduction of the price shield, energy inflation is predicted to start rising again. Food and manufactured goods inflation is only projected to normalise gradually and should remain high in 2023, reflecting the persistent pass-through of rising costs, and especially the high gas and electricity prices currently anticipated by futures markets. Services inflation should be buoyed by strong wage growth, but is expected to be kept in check by the capping of the housing rent reference index at 3.5% between July 2022 and June 2023.

In 2024, with the predicted easing of energy and food commodity prices, and long-term inflation expectations remaining anchored, headline inflation should subside to 2.7% in annual average terms as underlying inflation falls back to 2.5%.

The temporary slowdown in activity is expected to have a lagged and moderate impact on employment after the strong resilience seen in 2022

After reaching a low at the start of the year, the unemployment rate remained historically weak in the second quarter at 7.4%. Employment was symmetrically at an all-time high in France. In the second quarter of 2022, market sector salaried employment was 620,000 higher than before the crisis in 2019 (see Chart 5 below). It should remain relatively robust in the third quarter, based on the latest available data (figures on new hires, business surveys). Our projection takes into account INSEE’s inclusion of work-study contracts in its employment and labour force figures in June 2022, and expectations of robust growth in apprenticeship contracts.

However, under our benchmark scenario, market sector salaried employment should start to fall from the start of 2023 onwards as economic activity decelerates. With fewer job creations in 2023, and despite markedly slower growth in the labour force, the unemployment rate should increase slightly and then stabilise at around 8% in 2024 (see Chart 6), which is still slightly below the pre-crisis rate of 2019.