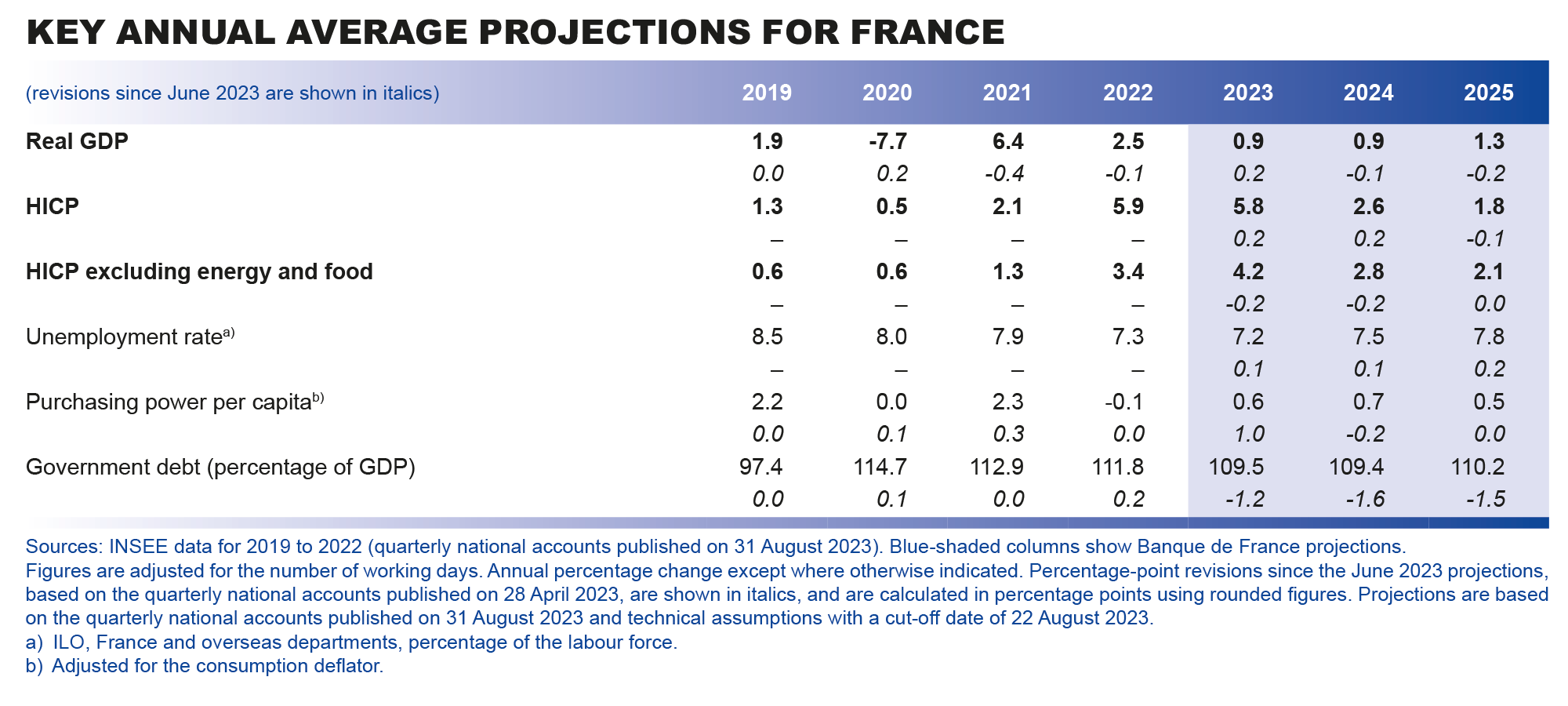

The scale of the recent jump in oil prices is different to the multiple commodity price shocks of 2021-22 and does not therefore invalidate our prediction of a downward trajectory for inflation

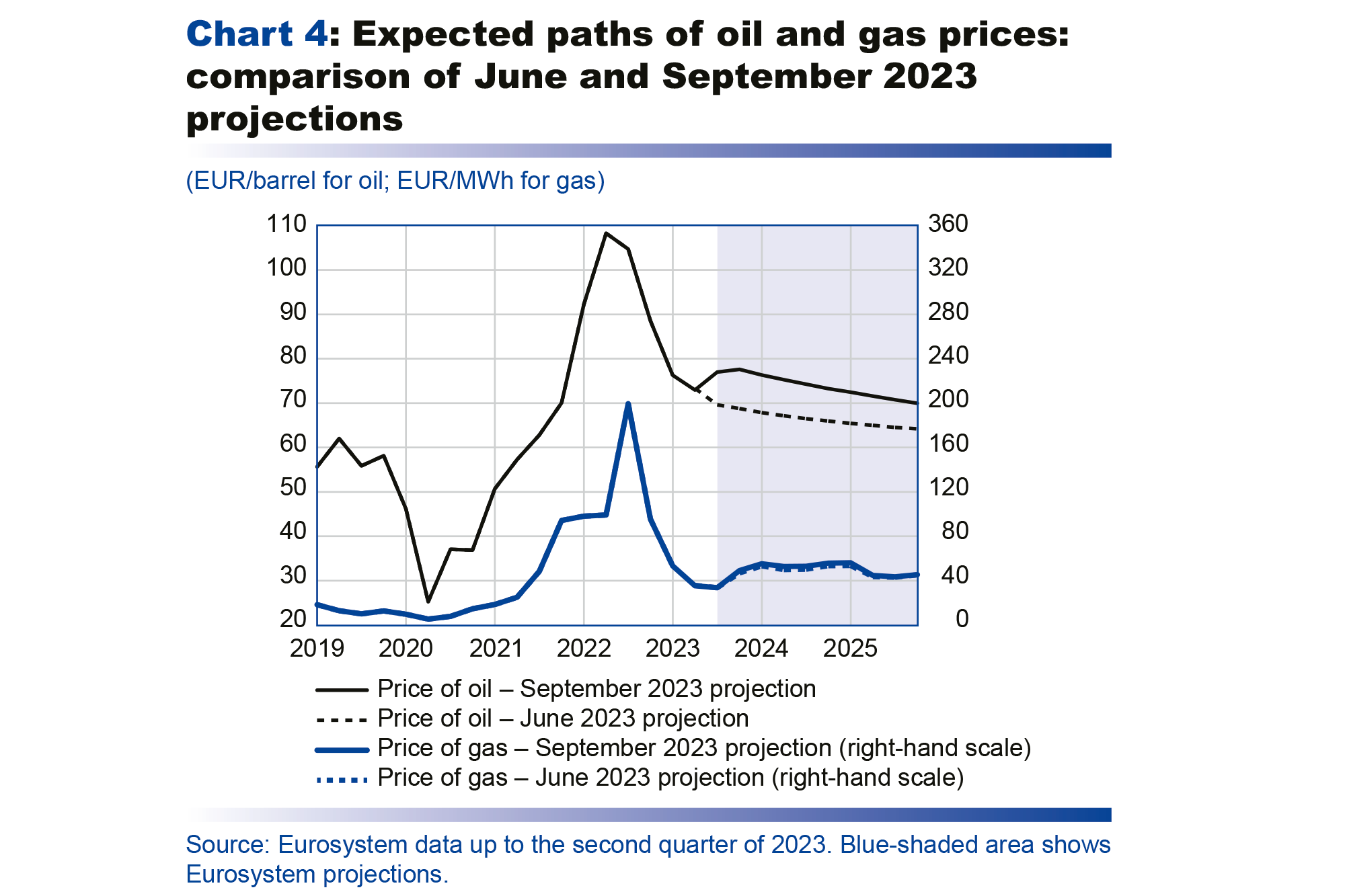

In summer 2023, the price of oil rose, mainly due to a decision on the part of OPEC and Russia to restrict supply, leading to fears that the fall in headline inflation that began in the first half of 2023 would be interrupted. However, these new price rises are of a different nature and nothing like the price shocks experienced in 2021 and 2022, which caused severe stress across all commodity markets (post-Covid recovery and supply difficulties followed by the Russian invasion of Ukraine, triggering a massive energy crisis), affecting the price of oil, gas and electricity, foodstuffs and certain metals.

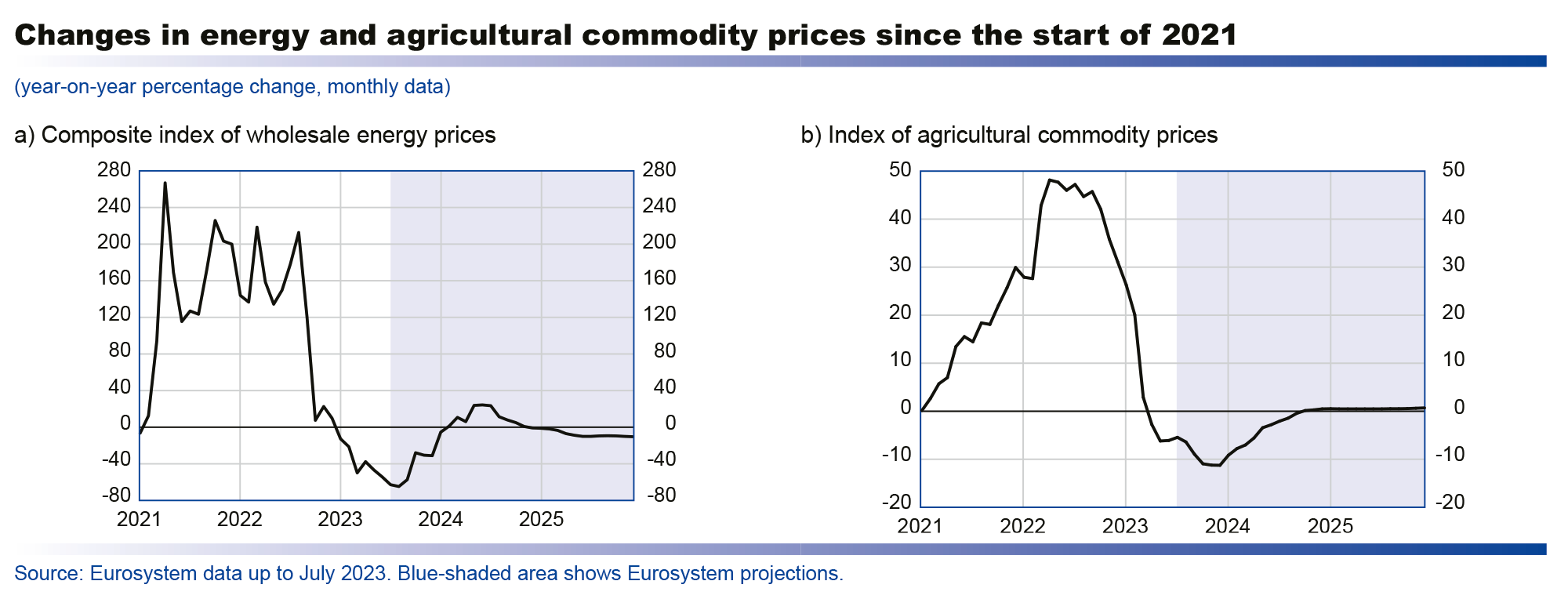

In the wake of the Ukrainian crisis, fears over European gas supplies pushed wholesale gas prices to unprecedented levels. This pressure also spread to wholesale electricity prices, which are largely determined by the price of gas because of the way the European energy market currently works (in France’s case, this contagion was exacerbated by problems encountered at its nuclear reactors). Overall, the year-on-year increase in the wholesale energy price – measured here by a composite index of wholesale gas and oil prices, expressed in euro per barrel of oil equivalent – hit highs of over 200% during 2021 and 2022 (see chart), before subsequently coming back down, but remaining at a higher level than in first-half 2021. At the same time, the year-on-year increase in agricultural commodity prices peaked at 48% in April 2022, mainly due to the slump in Ukrainian and Russian cereal exports.

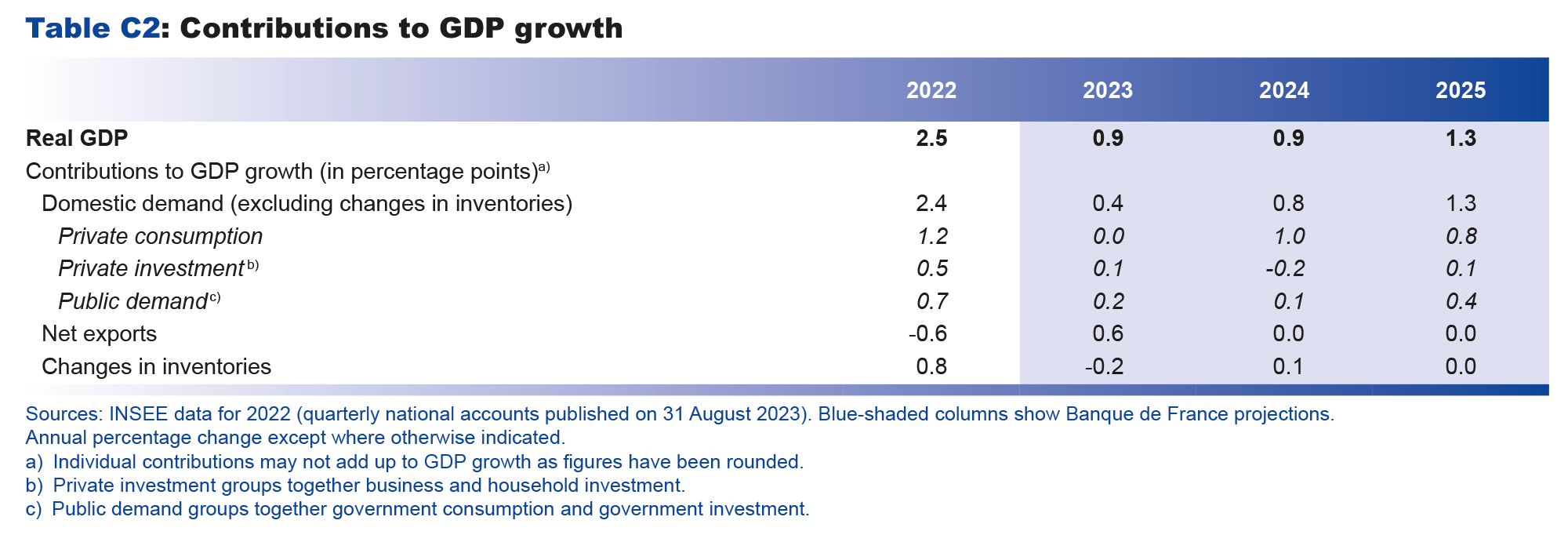

The situation is very different in the summer of 2023. As regards fossil fuels, the price shocks currently only affect oil and not gas, as fears of supply difficulties have eased considerably thanks to Europe's reduced dependence on Russian gas. Based on year-on-year price expectations on futures markets, the composite energy price index should gradually start climbing in summer 2023 to peak at 24% in June 2024. At the same time, agricultural prices are even expected to fall slightly as international markets gradually settle down again, although the price outlook on futures markets remains subject to considerable uncertainty. Moreover, in August 2023, the French government decided to increase the regulated electricity price by 10% to phase out the energy price shield. However, this corresponds to a normalisation of final prices rather than a new shock to wholesale prices.

In our projection, the energy component of French HICP inflation (Harmonised index of consumer prices) should decline between 2022 and 2025, from a jump of 24% in 2022 before virtually stabilising in 2025. The increase in the food component of French HICP inflation is expected to peak in 2023 at nearly 12%, before falling back to a little under 2% in 2025. Naturally, these projections are subject to the information currently available (see also the section on the risks to activity and inflation).