Working Paper Series no. 697: Monetary Policy and Corporate Debt Structure

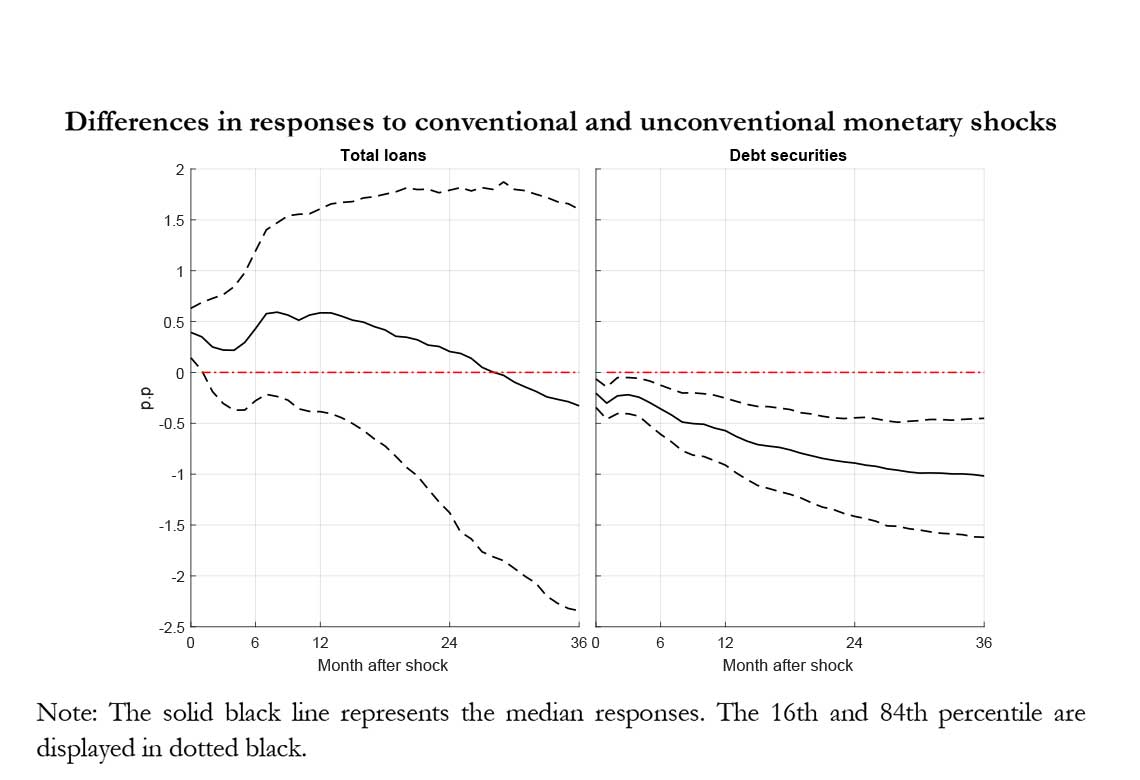

This paper evaluates and compares the effects of conventional and unconventional monetary policies on the corporate debt structure in the United States. It does so by using a vector autoregression in which policy shocks are identified through high-frequency external instruments. Stéphane Lhuissier and Urszula Szczerbowicz’s results show that conventional and unconventional expansionary monetary policies have similar positive effects on aggregate activity, but their impact on corporate debt structure goes in opposite directions: (i) conventional monetary easing increases loans to non-financial corporations and reduces corporate bond financing; (ii) unconventional monetary easing increases bond finance without affecting the loans.

The years following the Great Recession have been challenging in the field of theoretical monetary economics. The new forms of monetary policy implemented after the crisis, more commonly called "unconventional", were an important innovation that have encouraged economists to revise the existing theories. This paper aims at studying the transmission mechanism of U.S. monetary policy shocks on borrowing activities of non-financial corporations, during both conventional and unconventional policy periods. By doing so, we aim to provide a set of stylized facts on similarities and differences in transmission mechanisms across monetary policy regimes that would help generating improved business cycle models.

Specifically, we employ a vector autoregression (VAR) in which monetary policy shocks are identified with high frequency external instruments, along the lines of Stock and Watson (2012) and Mertens and Ravn (2013). For each monetary policy regime, we estimate our benchmark VAR model for the U.S. economy at monthly frequency with real interpolated GDP, consumer prices, the Gilchrist and Zakrajsek (2012)'s excess bond premium, and a measure of monetary policy stance. Because the nature of conventional and unconventional policy measures strongly differ, the instruments we use to identify exogenous monetary policy shocks are not the same across policy regimes.

Our results consistently show that dynamic effects of expansionary monetary policy are remarkably similar across the conventional and unconventional policy period, with a fall in the policy indicator and credit spread, and a persistent rise in output and prices. By extending our VAR model to a wider set of macroeconomic variables, we also show that our measures of expansionary monetary policy shocks are associated with long-lasting positive effects on consumption, residential and non-residential fixed investment, and employment under each monetary policy regime.

Nevertheless, we show that the transmission channels of conventional and unconventional monetary policies are not the same with respect to corporate credit (loans and debt securities) availability. We show that conventional monetary policy easing increases the share of the loans in corporate debt, while unconventional policy easing increases the bond financing share. We argue that unconventional monetary policy has an opposite effect on loans and bonds through their impact on longer-term corporate bond markets conditions.

Our approach compares the effects of U.S. conventional monetary policy on the macroeconomy and corporate debt structure with those of unconventional measures. Most of the studies focus exclusively on one of the two monetary policy regimes, and do not attempt to compare them with each other. Regarding conventional measures, see for example Leeper, Sims, and Zha (1996), Christiano, Eichenbaum, and Evans (1999) and more recently Gertler and Karadi (2015). Regarding unconventional measures, notable examples include Baumeister and Benati (2013), Gambacorta, Hofmann, and Peersman (2014) and Weale and Wieladek (2016). We also contribute to the literature on the monetary policy effects on the corporate debt structure, which is relatively scarce. Becker and Ivashina (2014) study conventional monetary policy shocks and find that a more restrictive stance pushes non-financial corporations towards bond markets. For the unconventional monetary policy period, Lo Duca, Nicoletti, and Vidal Martinez (2016) show that U.S. expansionary policies increased corporate bond issuance worldwide. A unified framework across conventional and unconventional monetary policy allows us to provide a set of stylized facts on similarities and differences in transmission mechanisms across monetary policy regimes that would help generating improved business cycle models. Our results imply that a successful model of the monetary transmission mechanism ought to consider two types of external debt as their responses differ deeply following a monetary policy shock.

Download the PDF version of this document

- Published on 10/17/2018

- 34 pages

- EN

- PDF (644.56 KB)

Updated on: 10/17/2018 13:05