Banque de France Bulletin no. 219: Article 1 Non-resident holdings of French CAC 40 shares at end-2017

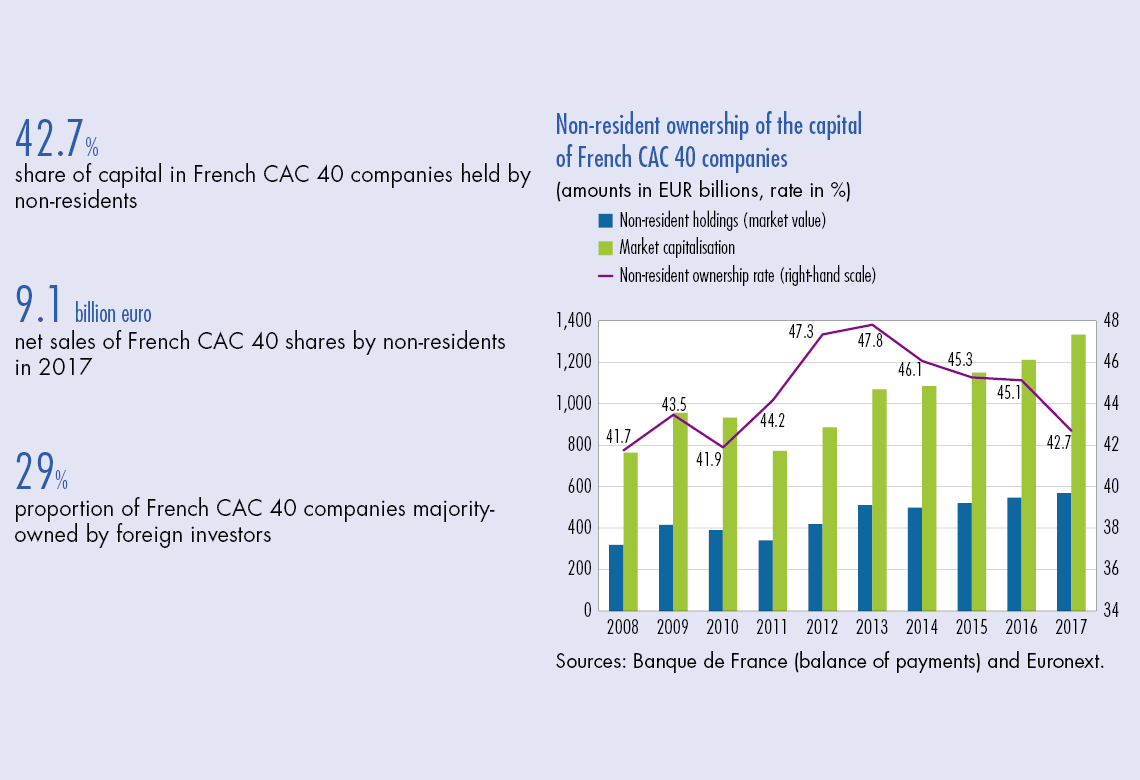

At the end of 2017, non-residents held EUR 569 billion worth of shares in French CAC 40 companies out of a total market capitalisation of EUR 1,332 billion, representing an ownership rate of 42.7% – down for the fourth consecutive year.

Based on end-2016 prices, non-residents sold a net total of EUR 9.1 billion of CAC 40 shares in 2017, while residents invested a net total of EUR 19.4 billion.

Some 44.6% of foreign investments in French equities and investment fund shares came from the euro area, 32.8% from the United States, 7.7% from the United Kingdom and just 14.9% from the rest of the world.

1 Non-resident ownership of French shares

Decline in non-resident ownership of French listed shares

As at 31 December 2017, non-resident investors held 42.7% of the total value of shares in the 34 French companies listed in the CAC 40.1 The figure was down 2.4 percentage points compared with the previous year (see Chart 1), continuing the decline observed since 2014.

Non-resident holdings of CAC 40 shares can be broken down into portfolio investments,2 which accounted for 91.5%, and direct investments, which accounted for 8.5%; the latter proportion was down 0.7 percentage point relative to 2016 (see Chart 2).

After declining for three consecutive years, non-resident ownership of French companies listed outside the CAC 40 increased by 0.6 percentage point. Measured across all French listed stocks, non-resident ownership fell by 1.7 percentage points to a total of 37.4% (see Chart 3).3

Less than 30% of French CAC 40 companies are more than 50%-owned by foreign investors

As at 31 December 2017, of the 34 French companies included in the CAC 40 index, only ten were majority owned by non-resident investors, down from 11 in 2016 and from 19 in 2013 (see Table 1).4 In general, those companies with the highest rates of non-resident ownership in 2016 were also those that registered the biggest falls in this rate in 2017.

Conversely, the biggest rises were seen mainly at companies with the lowest rates of non-resident ownership in 2016 (see Chart 4).

On average, the more volatile a company’s share price, the smaller the proportion of its capital that will be held by non-residents.5 This cross-sectional correlation holds true for nearly every year since 2008, suggesting that investors have a preference for stable stocks – as confirmed by an econometric analysis (see Appendix 2).

Non-resident ownership has declined in the majority of sectors

Only the technology and telecommunications sector saw a rise in the proportion of shares owned by non-residents in 2017. Financial corporations, meanwhile, registered the biggest fall (see Chart 5).

Non-resident ownership of French listed shares is low compared with rates in other European countries

Non-residents held 37% of all listed shares in France at end-2017 (with a market value of EUR 2,087 billion), compared with 50% in Spain and Italy (market value of EUR 715 billion and EUR 557 billion respectively), 55% in Germany (EUR 1,934 billion), 63% in the United Kingdom (EUR 2,218 billion), 68% in Belgium (EUR 390 billion)...

Download the PDF version of this document

- Published on 10/09/2018

- 9 pages

- EN

- PDF (402.68 KB)

Bulletin Banque de France 219

Updated on: 10/30/2019 18:38