Banque de France Bulletin no. 219: Article 2 Commercial real estate: is there a risk of a financial bubble?

Commercial real estate prices have been rising steadily for a number of years. In France in particular they are now higher than they were before the 2008 crisis. These high valuations appear consistent with the economic fundamentals – notably the low interest rate environment and tightness in supply relative to demand in certain segments of the market. However, the fundamentals currently differ markedly from historical levels, raising the risk that prices might correct downwards in the event of a sudden rise in interest rates or a deterioration in the economic outlook. If this were to happen, the systemic consequences would most likely be limited as commercial real estate only accounts for a small share of financial institutions’ exposures. However, we cannot rule out a possible contagion to firms and, to a lesser extent, households.

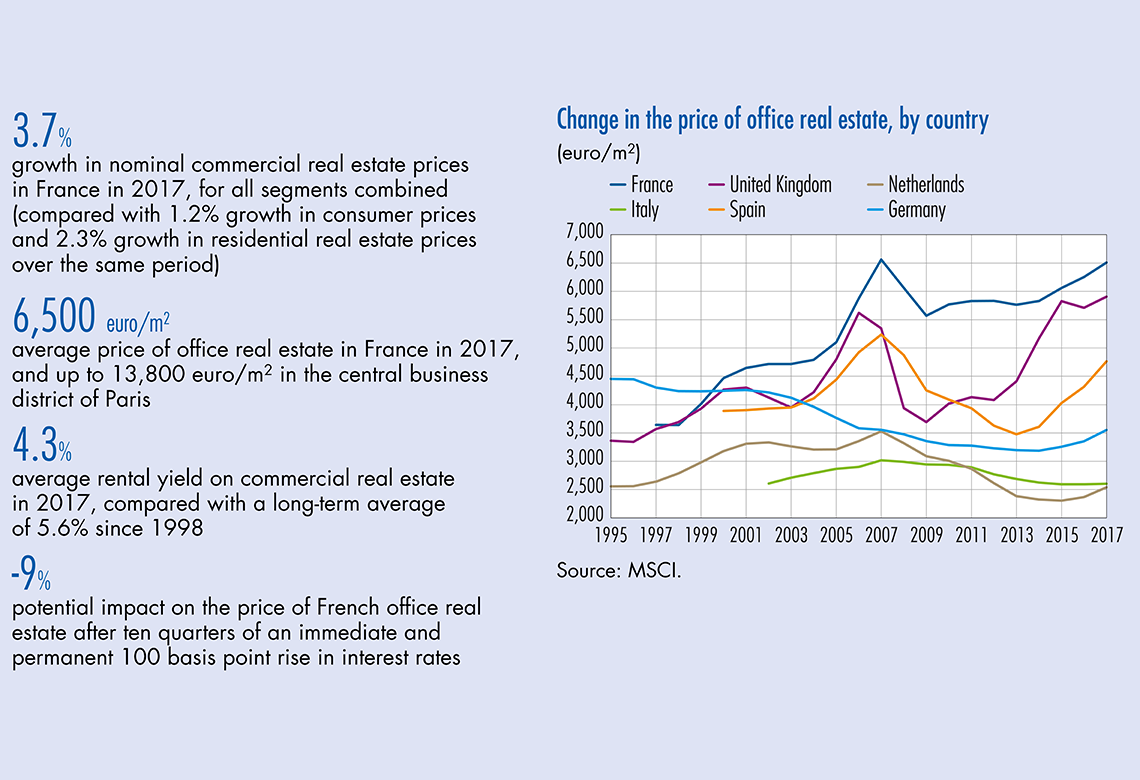

Commercial real estate prices have been rising steadily for a number of years. This is linked to the low interest rate environment which has made the risk/return ratio on these assets increasingly attractive relative to bond investments, leading in turn to a sharp rise in transaction volumes. The trend is particularly marked in France, where prices have been rising continuously since 2009 and are now above their pre-crisis level, especially in the office segment. This raises the question of whether commercial real estate is now overvalued, and if so how this might affect financial stability.

1 Price formation in the commercial real estate market

What is commercial real estate?

For the purposes of this article, commercial real estate is taken as referring to real estate assets held by professional investors who do not occupy the property but derive regular income from it. It therefore consists of real estate, either existing or under development, that is owned by institutional investors (insurers, investment funds), generally for the purpose of renting to businesses or households. This definition of commercial real estate, based on the type of owner, covers a wide variety of assets, ranging from business premises (shopping centres, small retail outlets, offices, warehouses, etc.) to residential buildings.

In France, the market accounted for EUR 330 billion of assets in 20173 and a total of 27 billion transactions a figure that needs to be set against some 200 billion purchases of new and second-hand dwellings by households over the same period. Commercial real estate is therefore only a small sub-segment of the overall property market, but one with a particularly strong international exposure (29% of purchases are by non-residents).

The underlying mechanisms differ in each segment

Commercial real estate groups together a range of properties that are not completely interchangeable in terms of purpose or use. A square metre of logistical premises located in the suburbs does not serve the same purpose as a high-street shop, and a high-street shop does not serve the same purpose as office space. As a result, the factors determining rent prices are liable to differ from one segment to another.

- Demand for offices depends on the level of employment, especially in the service industry, the “productivity” of available office space, and structural changes in modes of work such as the rise of dynamic working environments and teleworking…

Download the PDF version of this document

- Published on 11/29/2018

- 11 pages

- EN

- PDF (438.1 KB)

Bulletin Banque de France 219

Updated on: 10/30/2019 18:36