Working Paper Series no. 788: Nowcasting World GDP Growth with High-Frequency Data

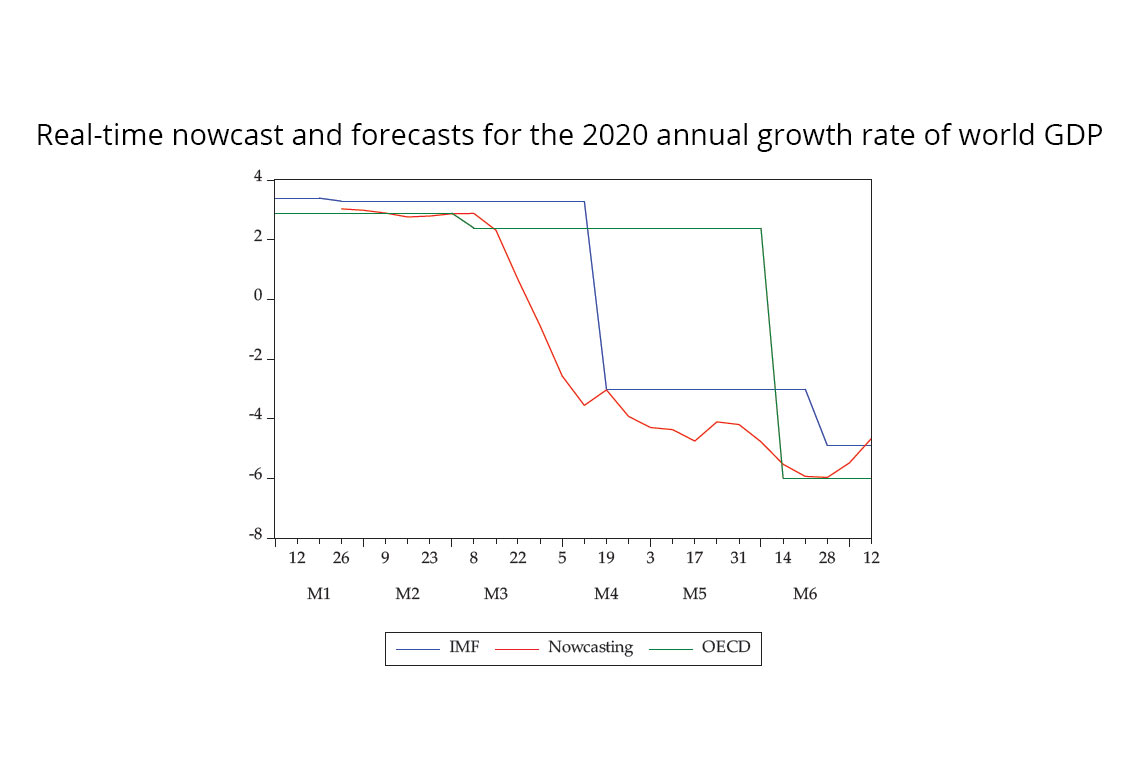

The Covid-19 crisis has shown how high-frequency data can help tracking economic turning points in real-time. Our paper investigates whether high-frequency data can also improve the nowcasting performances for world GDP growth on quarterly or annual basis. To this end, we select a large dataset of 151 monthly and 39 weekly series for 17 advanced and emerging countries representing 68% of world GDP. Our approach builds on a Factor-Augmented MIxed DAta Sampling (FA-MIDAS) which allows us to take advantage of our large database and to combine different frequencies. Models that include weekly data significantly outperforms other models relying on monthly or quarterly indicators, both in- and out-of-sample. Breaking down our sample, we show that models with weekly data have similar nowcasting performances relative to other models during “normal” times but strongly outperform them during “crisis” episodes (2008-2009 and 2020). We finally construct a nowcasting model of annual world GDP growth incorporating weekly data which give timely (one every week) and accurate forecasts (close to IMF and OECD projections, but with a 1 to 3 months lead). Policy-wise, this model can provide an alternative “benchmark” projection for world GDP growth during crisis episodes when sudden swings in the economy make the usual “benchmark” projections (from the IMF or the OECD) rapidly outdated.

The sudden shock of the Covid-19 crisis has put new emphasis on high-frequency data and a number of weekly, daily, or even hourly data have been extensively used to assess in real-time the impact of the Great Lockdown. In the meantime, world GDP forecasts provided by international organizations such as the OECD and the IMF – which are widely used as “benchmark” projections by economists – have been outdated shortly after their releases given the large and sudden swings in global economic conditions. This has left most macroeconomists with a lack of “benchmark” projections for world GDP. The purpose of this paper is to assess whether high-frequency data can be used to nowcast world GDP growth and therefore provide an alternative “benchmark” projection during those particular times.

Our approach builds on the Factor-Augmented MIxed DAta Sampling (FA-MIDAS) proposed by Marcellino and Schumacher (2008). This set-up suits best our purpose since: (i) we mix multiple frequencies by forecasting annual/quarterly GDP growth using monthly macroeconomic variables (e.g. retail sales, PMIs) and weekly indicators (e.g. US jobless claims, stock market indexes); and (ii) rely on the aggregation of multiple national variables to make up for the lack of timely global variables. In this vein, we select a large dataset of 151 monthly variables and 39 weekly series out of around 500 monthly and 250 weekly potential regressors. This dataset covers 17 countries representing 68% of world GPD. We then apply a principal component analysis to extract the common trends from these cross-national datasets at both monthly and weekly frequencies. Finally, we run MIDAS regressions to forecast annual/quarterly world GDP growth using monthly and weekly factors as explanatory variables. To test whether high-frequency data enhance performances, we compare performances across different models including (or not) subsets of weekly data, monthly data, or an AR annual/quarterly term. While comparisons are based on in-sample and out-of-sample RMSE, we also test more formally for significant differences in predictive accuracy using the tests developed by Diebold and Mariano (1995).

We find evidence that high-frequency data improve nowcasting performance. Accuracy – both in-sample and out-of-sample – is significantly enhanced when a model includes weekly data relatively to models based only on monthly or quarterly indicators. Performance is at its peak when weekly data is included separately in a specific weekly factor rather than when averaged and incorporated in the monthly factor. This finding is robust to different MIDAS specification and to changes in the dataset. In line with the intuition that high-frequency might be only of second-order when economic conditions are stable, we find that models with weekly data greatly enhance in- and out-of-sample performances during “crisis” episodes (2008-2009 and 2020) but have performances similar to other models during other “normal” periods.

Finally, coming back to our purpose of providing an alternative “benchmark” projection at higher-frequency, we build a nowcasting model for annual world GDP growth using our weekly data. The real-time experience during the Covid-19 crisis shows that this model provides timely estimates for world GDP growth with a 2-3 months lead on IMF and OECD releases (cf. Figure 1). It can therefore serve as an alternative “benchmark” projection during those “crisis” episodes when institutional projections are rapidly outdated and when the predictive power of high-frequency data is the greater.

Download the PDF version of this document

- Published on 12/11/2020

- 37 pages

- EN

- PDF (2.37 MB)

Updated on: 12/11/2020 17:05