Rue de la Banque no. 55: The role of real estate in euro area wealth inequality: lessons from the Household Finance and Consumption Survey

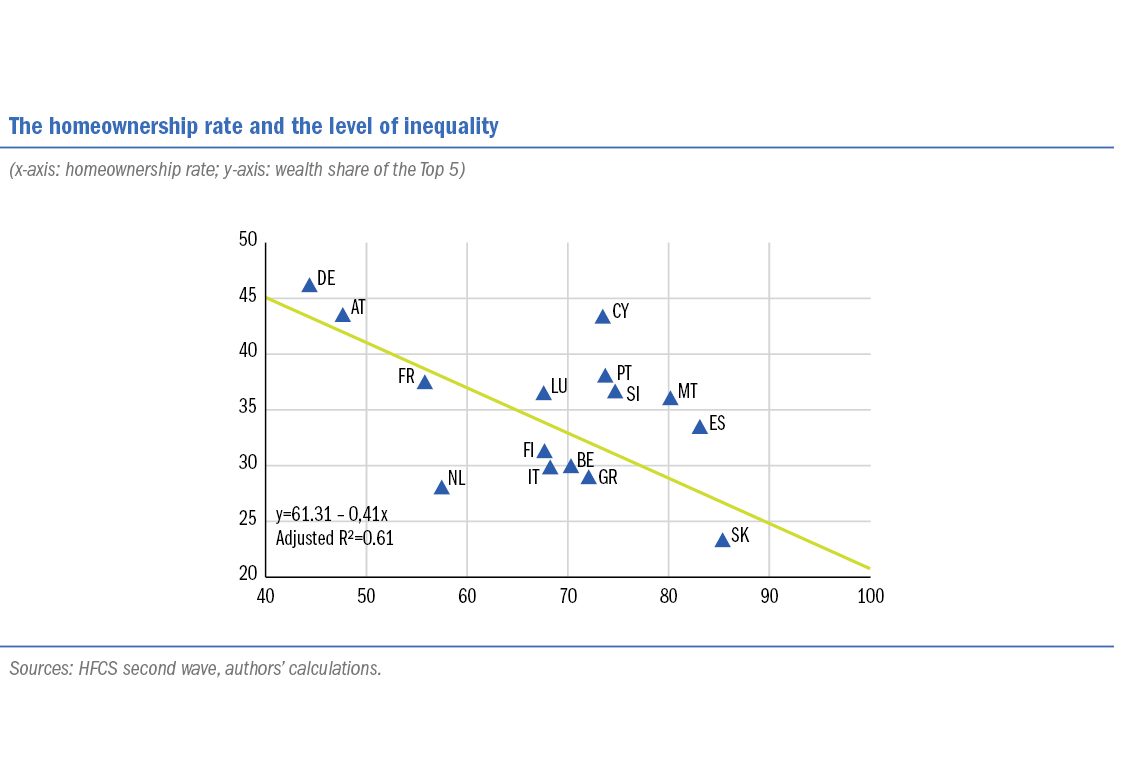

We analyse the role of real estate in wealth inequality within the euro area using data from the Eurosystem’s Household Finance and Consumption Survey. We demonstrate that the level of inequality declines with the homeownership rate. Furthermore, the real estate prices of the properties of the richest homeowners are highest in the most inegalitarian countries. The changes in wealth inequality observed in euro area countries from 2010 to 2014 are essentially the result of the decline in the net value of property wealth (due to both a fall in prices and a rise in debt). The effects vary depending on the countries and wealth groups.

In light of the finding that inequalities are widening, several economists have investigated the role that may be played by changes in asset prices (see Adam and Tzamourani, 2016, and Adam and Zhu, 2016). Changes in asset prices are likely to have an impact on the evolution in inequalities because of the heterogeneity of the composition of household wealth.

This Rue de la Banque uses data from the Eurosystem’s Household Finance and Consumption Survey (HFCS) to present an original analysis of the role played by real estate in inequality and its evolution in euro area countries from 2010 to 2014. We begin by analysing and documenting two key features:

- real estate accounts for the bulk of household wealth in the euro area, but significant disparities exist between countries;

- since 2010, while wealth inequality has widened slightly across the entire euro area (see Household Finance and Consumption Network (HFCN), 2016), dynamics have differed from country to country.

Download the PDF version of this document

- Published on 01/25/2018

- 5 pages

- EN

- PDF (637.58 KB)

Updated on: 01/25/2018 12:45