Working Paper Series no. 682: Shocks vs Menu Costs: Patterns of Price Rigidity in an Estimated Multi-Sector Menu-Cost Model

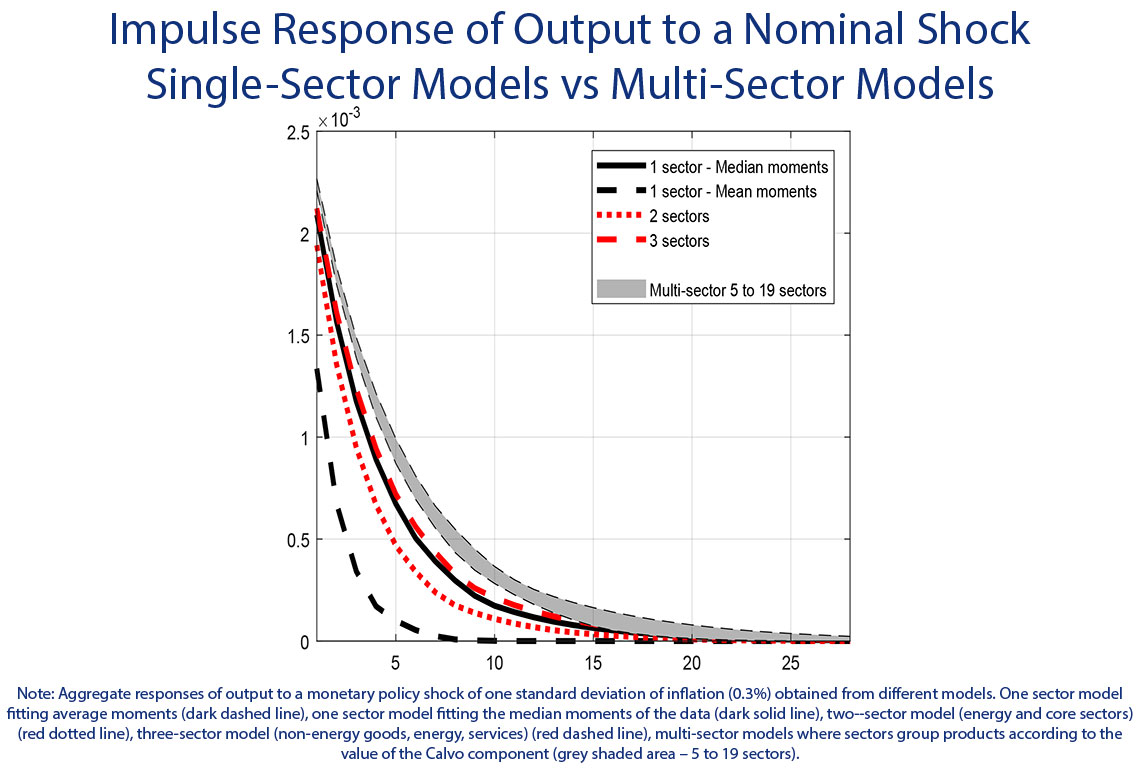

Relying on a menu-cost model augmented with a time-dependent (Calvo) component, Erwan Gautier and Hervé Le Bihan investigate the structural sources of cross-sectoral heterogeneity in patterns of price setting. They use a large micro dataset of French consumer prices to estimate the model at the product level for 227 products. The Calvo component is found to be large in most sectors. Heterogeneity in structural parameters is also substantial. The combination of these two features leads to much larger real effects of monetary policy. The effect of monetary shock on output is more than 4 times larger than the one derived from a standard single-sector menu-cost model estimated using average moments.

A voluminous literature has described patterns of price adjustments both in the United States and the euro area. Two salient features of the micro price dynamics are often reported. First, prices are quite rigid since the frequency of price changes is small (especially when sales-related price changes are disregarded). Second, cross-sectoral heterogeneity is pervasive: price changes are for instance quite frequent in energy but rather rare in services. A still open question is to what extent these patterns of price rigidity reflect underlying features of pricing frictions or characteristics of the shocks hitting the different sectors. This paper provides new evidence on the empirical relevance of pricing frictions frequently used in macro models and on the origins of cross-sectoral heterogeneity in price rigidity. We also derive macro implications of our results for the real effects of monetary policy.

To address this issue, we rely on a structural multi-sector menu cost model, which nests the standard menu cost model and the Calvo model of “exogenous”' price rigidity. Using this model, and a minimum distance estimation procedure, we estimate the value of the menu cost, the Calvo component (the probability of drawing a free opportunity to change prices), and the parameters characterizing the variance and persistence of sectoral productivity shock process at the product level. We estimate this model for more than 200 different products of the French CPI. Empirical moments are obtained using a large microeconomic data set of more than 25 million of individual consumer price quotes. The general equilibrium set-up used allows us to simulate the response of the economy to a monetary shock, and assess the degree of the monetary non-neutrality. We compare the aggregate response for different estimations of parameters of the model (one sector vs. multi-sector, augmented menu cost model vs Calvo or pure menu cost model) and we also compare the impulse response functions obtained for France and the US economy.

Our main results are the following:

- There is a substantial degree of heterogeneity across sectors in all structural parameters.

- The Calvo component plays a crucial role to fit the data and is the main source of price rigidity. The genuine “menu cost” component contributes only partially to the overall degree of price rigidity. Across sectors, the heterogeneity in the Calvo component (as opposed to heterogeneity in cost shocks) explains most of the heterogeneity in the frequency of price changes across products.

- Product heterogeneity matters for monetary policy: the degree of monetary non neutrality is much larger in a multi-sector model than in a one-sector model calibrated on the same average moments. However, a single-sector model estimated using median moments is able to generate the same degree of non-neutrality than multi-sector models.

- A 3-sector model (energy, services and manufacturing goods) is able to generate the same degree of monetary non-neutrality as a multi-sector model with much more products. Our results also suggest that the amplification of non-neutrality due to product heterogeneity is mostly coming from heterogeneity in the Calvo component.

- Using models estimated on comparable US and French price moments and assuming that aggregate parameters (i.e. parameters other than the ones related to productivity and price-setting frictions) are identical in both economies, the degrees of monetary non-neutrality are quite similar in both economies.

Download the PDF version of this document

- Published on 05/24/2018

- EN

- PDF (927.68 KB)

Updated on: 05/24/2018 16:51