Working Paper Series no. 796: This Town Ain't Big Enough? Quantifying Public Good Spillovers

Despite long-standing theoretical interest, empirical attempts at investigating the appropriate level of decentralization remain scarce. This paper develops a simple and flexible framework to test for the presence of public good spillovers between fiscally autonomous jurisdictions and to investigate potential welfare gains from marginal fiscal integration. We build a quantitative spatial equilibrium model with many local jurisdictions, mobile households and endogenous local public goods causing spillovers across jurisdictional boundaries. We show how one can exploit migration and housing price responses to shocks in local public goods at different geographic scales to reveal the intensity of spillovers. Applying our framework to the particularly fragmented French institutional setting, we structurally estimate the model using a unique combination of municipal administrative panel datasets. Estimation relies on plausibly exogenous variations in government subsidies to instrument changes in the supply of public goods. We find that public goods in a municipality account for 4--11\% of the local public good bundle enjoyed by its residents, and that public goods in each neighbor municipality account for an average 3.2--3.5\% of this bundle. Finally, we simulate the effect of a reform increasing fiscal integration and find substantial welfare gains.

Take an economy divided into geographically distinct jurisdictions. Who should be providing local public goods? Local governments or the central government? On the one hand, decentralization may be inefficient because of spatial spillovers, i.e., the extent to which a jurisdiction's local public goods also benefit its neighbours. When spillovers are strong, local jurisdictions may under-provide local public services as they do not internalize their benefits to neighbour jurisdictions. In addition, jurisdictions may actively free-ride on neighbour jurisdictions' public goods, worsening the under-provision problem. On the other hand, the political economy of centralized decision-making may misallocate local public services.

Despite long-standing theoretical interest, empirical attempts at investigating the intensity of local public good spillovers and henceforth the appropriate level of decentralization remain scarce.

This paper develops a simple and flexible framework to test for the presence of public good spillovers between fiscally autonomous jurisdictions and to investigate potential welfare gains from marginal fiscal integration.

We build a quantitative spatial equilibrium model with many local jurisdictions and mobile households that choose in which jurisdiction they live in. Local amenities, rents, wages, and local public good characterize jurisdictions. Inhabitants of jurisdiction vote for local public good quantity and taxes that maximize their utility. Wages and rents clear labour and housing markets. Inhabitants of a jurisdiction may value local public goods of neighbouring jurisdiction; hence, there might be local public good spillovers across jurisdictional boundaries.

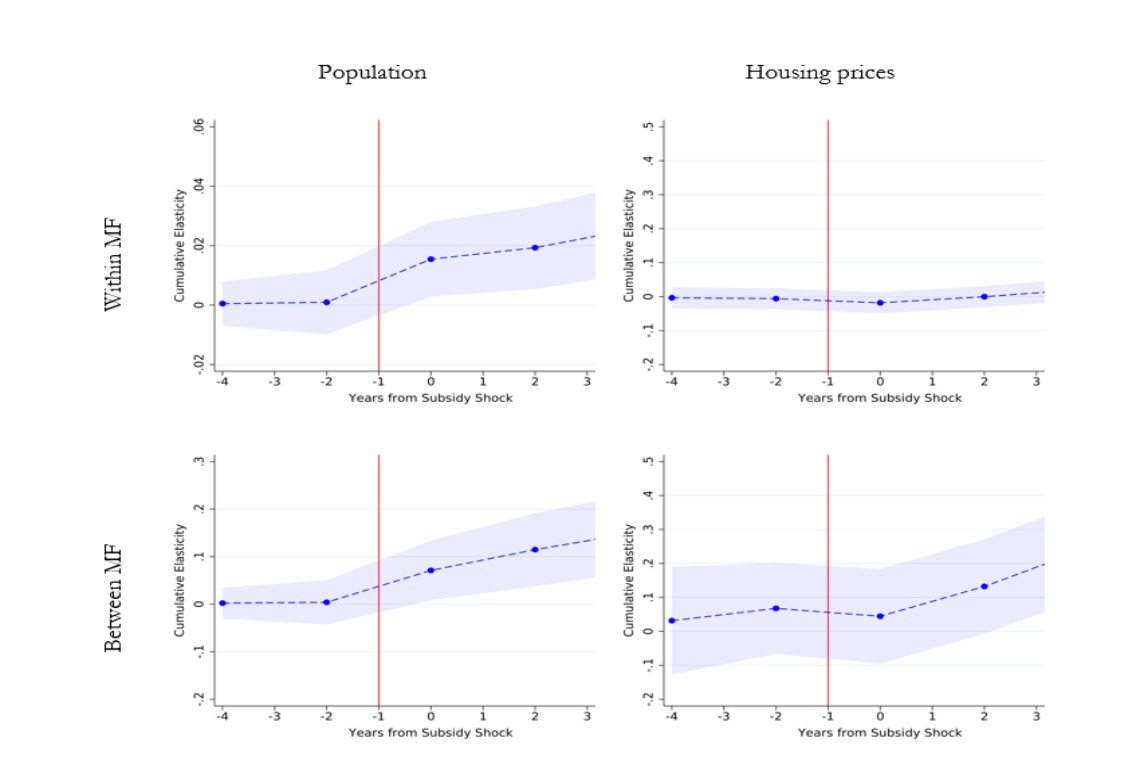

We show how one can exploit population and housing price responses to shocks in local public goods at different geographic scales to reveal the intensity of spillovers. We interpret a stronger response, in terms of population, housing consumption and housing prices, at a greater geographic level, as evidence of stronger public good spillovers within the smaller geographic level.

We apply our framework to the particularly fragmented French institutional setting. Here the greater geographic level are municipal federation and the smaller are municipalities. We structurally estimate the model using a unique combination of municipal administrative panel datasets.

Estimation relies on plausibly exogenous variations in government subsidies that we use to instrument changes in the supply of public goods.

We find that public goods in a municipality account for 4--11\% of the local public good bundle enjoyed by its residents, and that public goods in each neighbour municipality account for an average 3.2--3.5\% of this bundle. Finally, we simulate the effect of a reform increasing fiscal integration and find substantial welfare gains.

Download the PDF version of this document

- Published on 12/30/2020

- 61 pages

- EN

- PDF (4.77 MB)

Updated on: 12/30/2020 16:15