Working Paper Series no. 639: U.S. Savings Banks' Demutualization and Depositor Welfare

Originally, U.S. savings banks were owned by their depositors. In recent decades, many savings banks have “demutualized”, by converting from customer to investor ownership. We examine the implications of such events for depositor welfare. We introduce a random coefficients logit model of bank account choice and estimate depositors' tastes for bank characteristics (including banks' ownership type). We then measure the effect on depositor welfare of a simulated demutualization of all customer-owned savings banks. We find that depositors' welfare would increase on average. In particular, if demutualized savings banks offered a deposit rate in line with existing demutualized banks, each depositor would gain $1.14 annually, for a total of $22 million for each state and year.

Many banking systems around the world feature banks owned by their customers, as well as those owned by investors. In this paper, we study the effects on depositor welfare of the conversion from customer to investor ownership (i.e., the “demutualization”) of U.S. savings banks. Our findings indicate that 1) depositors base their choice of bank deposit account on the bank ownership type, and 2) that they, on average, would benefit from a demutualization of customer-owned savings banks.

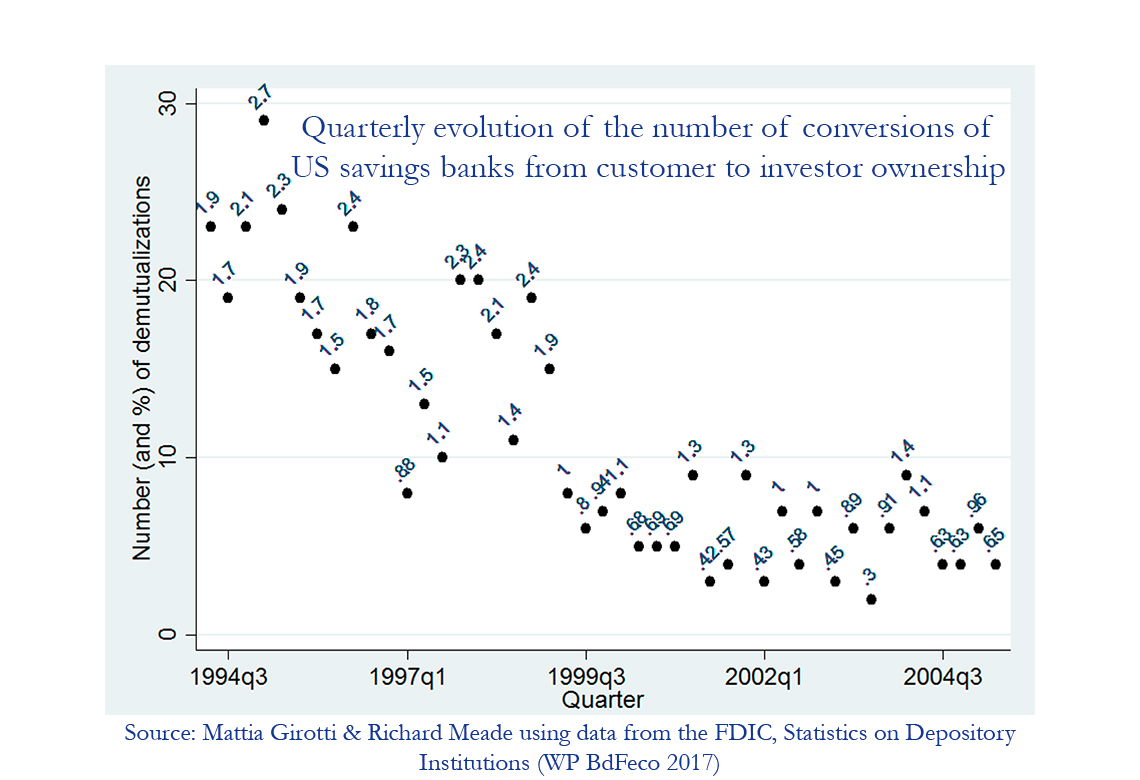

Historically, all U.S. savings banks were customer-owned. They were established in the nineteenth century as a means of providing banking services to households and small firms, which were unprofitable for commercial banks to serve. Indeed, customer ownership is associated with the joint maximization of profits and customer surplus, not just profits as in investor-owned banks. In recent decades, however, many customer-owned savings banks demutualized. The following figure shows that between 1994 and 2005 from four to eight per cent of the existing customer-owned savings banks demutualized every year. Since customer ownership is associated with consumer surplus maximization, it is natural to consider the implications of demutualizations for customer welfare.

We first derive theoretically the implications of customer-ownership for bank performance. We obtain that customer-owned banks should offer a higher deposit rate than investor-owned banks. We then develop an empirical model of bank deposit account choice, in which each depositor derives utility from a bank account depending on the deposit rate offered and on other bank characteristics. Specifically, we allow for bank type – i.e. the attribute of “being a savings bank” (whether investor- or customer-owned), and more particularly “being customer-owned” – to feature in depositors' bank evaluations, as well as in depositors' sensitivity to the deposit rate offered. We estimate our empirical deposit supply model using state-level data for U.S. commercial and savings banks from 1994 to 2005.

The estimation results indicate that depositors base their bank deposit choice on considerations beyond just deposit rate, and even their evaluation of deposit rate itself is influenced by other factors (here, bank ownership type). Most importantly, we find that customer-owned savings banks are perceived differently from investor-owned savings banks, and are preferred for a high level of the deposit rate. In light of our stylized theoretical investigation, we interpret these empirical findings as indicating that depositors prefer customer-owned savings banks to investor-owned savings banks only if they perceive that such banks are maximizing customer surplus in practice, and therefore paying sufficiently higher deposit rates.

The parameters that we recover from the estimation represent the estimates of depositor tastes' for each of the bank characteristics. We then use them to conduct the policy experiment in which all customer-owned savings banks are assumed to convert to investor ownership, and estimate the impact of this on depositor welfare. We obtain that every depositor would gain, on average, more than one dollar ($1.14) per year if demutualized banks lost their “customer-ownership” attribute and offered a deposit rate in line with other investor-owned savings banks. The corresponding market-wide welfare effect of such simulated demutualization is estimated to be $22 million per state-year.

Our conclusion is that depositors, on average, would benefit from a demutualization of customer-owned savings banks. As highlighted above, such banks should, all other things being equal, offer higher deposit rates than investor-owned savings banks. In practice, customer- and investor-owned savings banks pay similar deposit rates, and sometimes investor-owned savings offer higher rates. So, on the one hand customer-owned savings banks do not pay deposits “enough” to be perceived customer surplus maximizers. On the other hand, if demutualized savings banks paid the same as other investor-owned savings banks, they would offer higher rates than if they were still customer-owned. This is why a complete demutualization is expected to increase depositors' welfare.

Download the PDF version of this document

- Published on 09/04/2017

- FR

- PDF (2.26 MB)

Updated on: 09/04/2017 11:43