Banque de France Bulletin no. 233: Article 3 The financial position of French companies: strengths and weaknesses on the eve of the pandemic

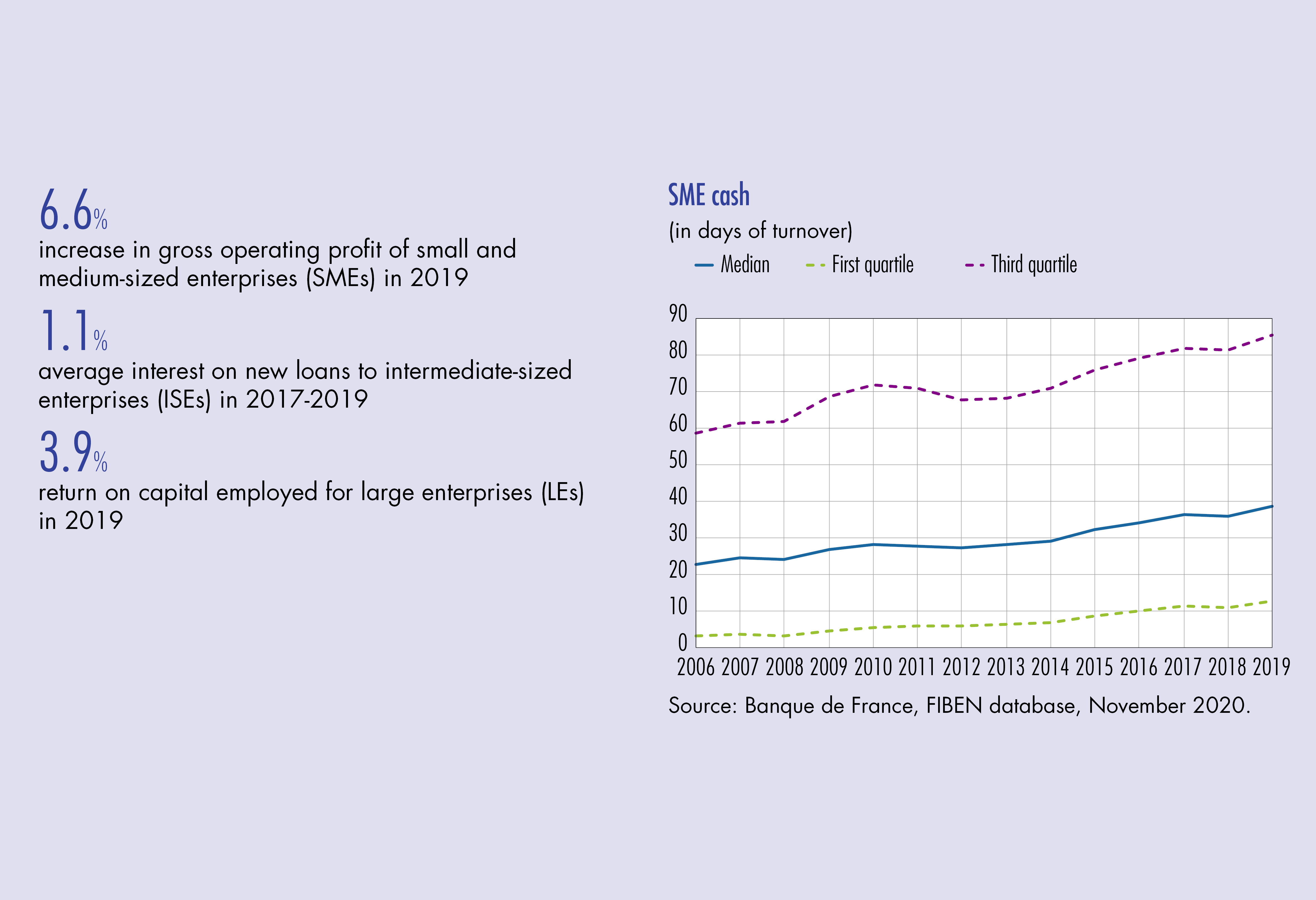

Non financial corporations entered the pandemic with several factors in their favour: three straight years of robust growth, higher profit shares, consistently low interest rates and increasing cash balances.

Leverage ratios were down for SMEs, and up for intermediate sized enterprises and large enterprises. Still, with their more limited access to market financing, SMEs in 2020 found themselves in great need of government backed loans; by end November, SMEs would account for 75% of such borrowing.

The prospect of higher business debt in 2020 (largely offset, it is true, by increased cash) did highlight some weaknesses: companies were less profitable than on the eve of the 2008 crisis; their working capital requirement had risen in 2019; and their debt repayment capacity was only improving slowly. Moreover, these average trends masked individual company financial conditions that had grown worse.

This article analyses the economic and financial position of French companies in 2019 using the set of corporate financial statements in FIBEN, a database maintained by the Banque de France. The study encompasses non financial corporations

located in France with an annual turnover of over EUR 750,000. It thus includes small and medium sized enterprises (SMEs), intermediate sized enterprises (ISEs) and large enterprises (LEs).

1 Business activity remained brisk in 2019

Turnover growth remained strong

Business revenue growth in France remained strong in 2019 at 2.7%, although more modest than the big jumps in 2017 of 4.9% and 2018 of 4.4% (see Table 1). The deceleration was more pronounced among LEs (up 1.7% in 2019 following 3.9% in 2018) and ISEs (up 2.5% following 4.4%) than among SMEs, where turnover rose considerably (up 5.1% in 2019 on top of 5.3% in 2018.)

Growth in total turnover was particularly constrained by export revenue, which rose 0.2% in 2019 as compared with 6.5% in 2017 and 5.6% in 2018. This measure stalled in 2019 for both ISEs and LEs, after major increases in 2017 and 2018. By contrast, SMEs held up well on this measure, with export revenue growth of 3.3%.

EBITDA grew significantly

Growth in value added remained at high levels in 2019, up 3.5% following 3.0% in 2018. Growth was significant for businesses of all sizes: 4.7% for SMEs, 2.6% for ISEs and 3.4% for LEs (see Table 2).

The year 2019 saw the reform of CICE, the French tax credit “for competitiveness and employment.” Companies thus enjoyed both the CICE on wages paid before 2019 and a reduction in employer contributions, which replaced the CICE, on compensation paid from 1 January 2019 forward. Therefore, employee expenses rose less rapidly than in years past: up 2.7% in 2019 vs. 4.0% in 2018 and 3.7% in 2017. The rise was still significant, especially with respect to SMEs (up 4.4%). In fact, though lower taxes and contributions reduced labour costs, other factors such as strong job growth, highlighted by Insee, pulled in the opposite direction. In our study sample, moreover, we see that growth in wages before taxes and contributions and in external employee expense was especially high for SMEs, at 4.6% and 6.6% respectively.

After increasing three years in a row, production levies levelled off in 2019 (down 0.2%). It is worth noting that the government’s September 2020 stimulus plan announced an ongoing EUR 10 billion…

Download the PDF version of this document

- Published on 03/29/2021

- 17 pages

- FR

- PDF (510.4 KB)

Bulletin Banque de France 233

Updated on: 03/29/2021 10:01