Banque de France Bulletin no. 223: Article 1 A new Banque de France Financial Conditions Index for the euro area

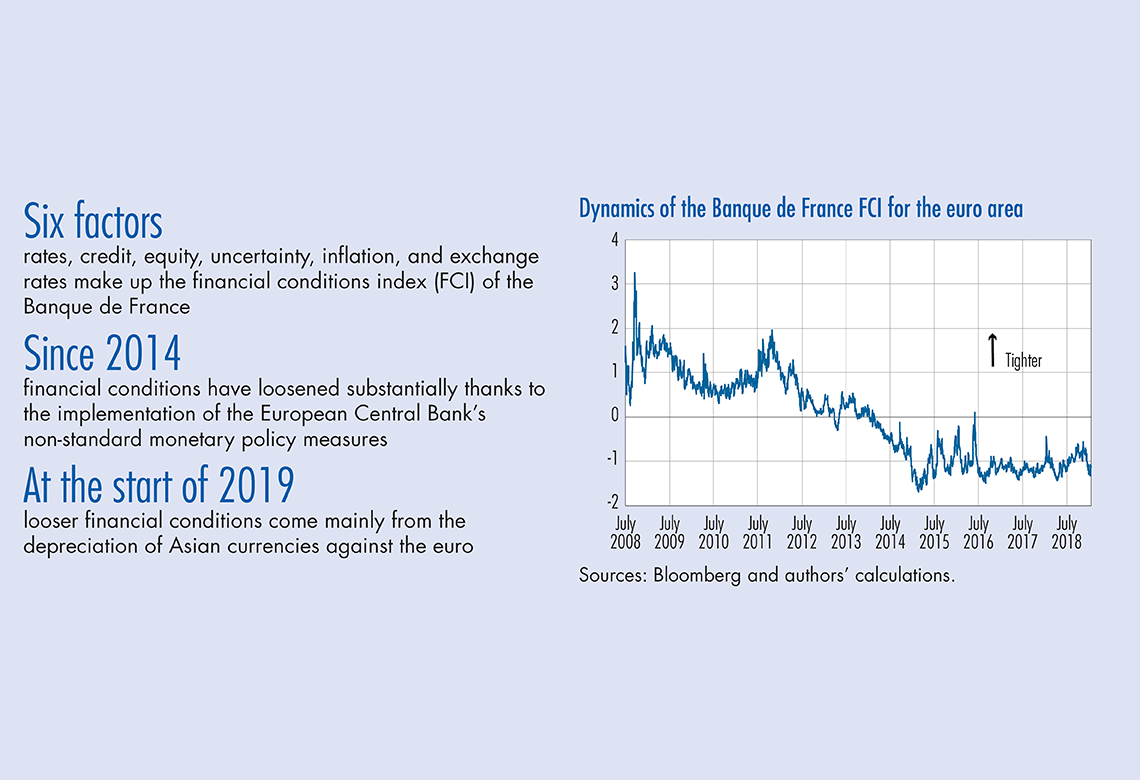

Financial conditions matter for the conduct of monetary policy. Over time, the scope of financial variables with a significant impact has increased, calling for the creation of an aggregate indicator – the financial conditions index (FCI) – that would summarise the information. The need for an aggregate indicator has gained even further traction since the 2008 global financial crisis as the usual monetary policy reference for financial conditions – the short-term interest rate – has become much less informative once stuck at its lower bound. This article presents a new FCI for the euro area with time-varying component weights. It is based on a set of financial series regularly monitored by the Banque de France and which pinpoints the sources of changes in financial conditions. Since 2014, financial conditions have loosened substantially thanks to the implementation of the European Central Bank’s non-standard monetary policy measures.

A financial conditions index (FCI) can be seen as a barometer of the health of financial markets. Economists and market analysts have therefore constructed such indices as a way of analysing the effects of changes to financial conditions on the real economy. However, tracking developments in the financial sector has become increasingly difficult and there is still no consensus among experts about the correct way to estimate FCIs. The purpose of this article is to explain the construction of an alternative FCI that relies on a principal component analysis and on time-varying component weights. We compare its evolution with other FCIs and discuss the way in which it can be used for policy purposes (bearing in mind some well-known caveats with FCIs).

1 Key technical challenges in the calculation of financial conditions indices

The key advantage of our framework compared to other methodologies is threefold: (i) it is based on a broader dataset; (ii) it is transparent; and (iii) it tracks the contribution of the main drivers of the Banque de France FCI (uncertainty, rates, credit, exchange rates, etc.). Furthermore, it is able to adjust to the rapidly changing environment of the financial sector through the time-varying weights attributed to each driver (see Box for details about the underlying methodology).

Data selection

Financial conditions are important because they influence current and future economic activity in ways that are not fully captured by the short-term interest rate, especially in times of crisis. For instance, asset prices are prime determinants of changes in the valuation of private sector portfolios, and therefore changes in private wealth, which affect the future spending behaviour of the private sector. Consequently, an FCI should cover a wide spectrum of data in order to keep track of various sources of complications in the financial sector. Our FCI is based on 18 daily series divided into 6 main components: rates, credit, equity, uncertainty, inflation, and exchange rates (the Appendix provides the details on the underlying data). The use of 18 financial series makes the Banque de France FCI the broadest index among established FCIs.

Traceability and tractability

Most FCIs do not report the underlying datasets and estimation procedures, and are therefore difficult to replicate and, sometimes, interpret. The Banque de France FCI is calculated using a clear and tractable methodology, which makes the index transparent and replicable.

Aggregate index with time-varying weights

An FCI should also be able to…

Download the PDF version of this document

- Published on 05/27/2019

- 7 pages

- EN

- PDF (574.64 KB)

Bulletin Banque de France 223

Updated on: 12/03/2019 12:08