Banque de France Bulletin no. 234: Article 4 Responsible investment: an issue of growing importance for the Banque de France and the central banking community

Over recent years, responsible investment has come to the fore as a major focus of work by central banks.

The Central Banks and Supervisors Network for Greening the Financial System (NGFS), whose secretariat is provided by the Banque de France and based in Paris, has played a driving role in encouraging NGFS member central banks to integrate sustainability factors into own portfolio management and thus set an example for other financial participants.

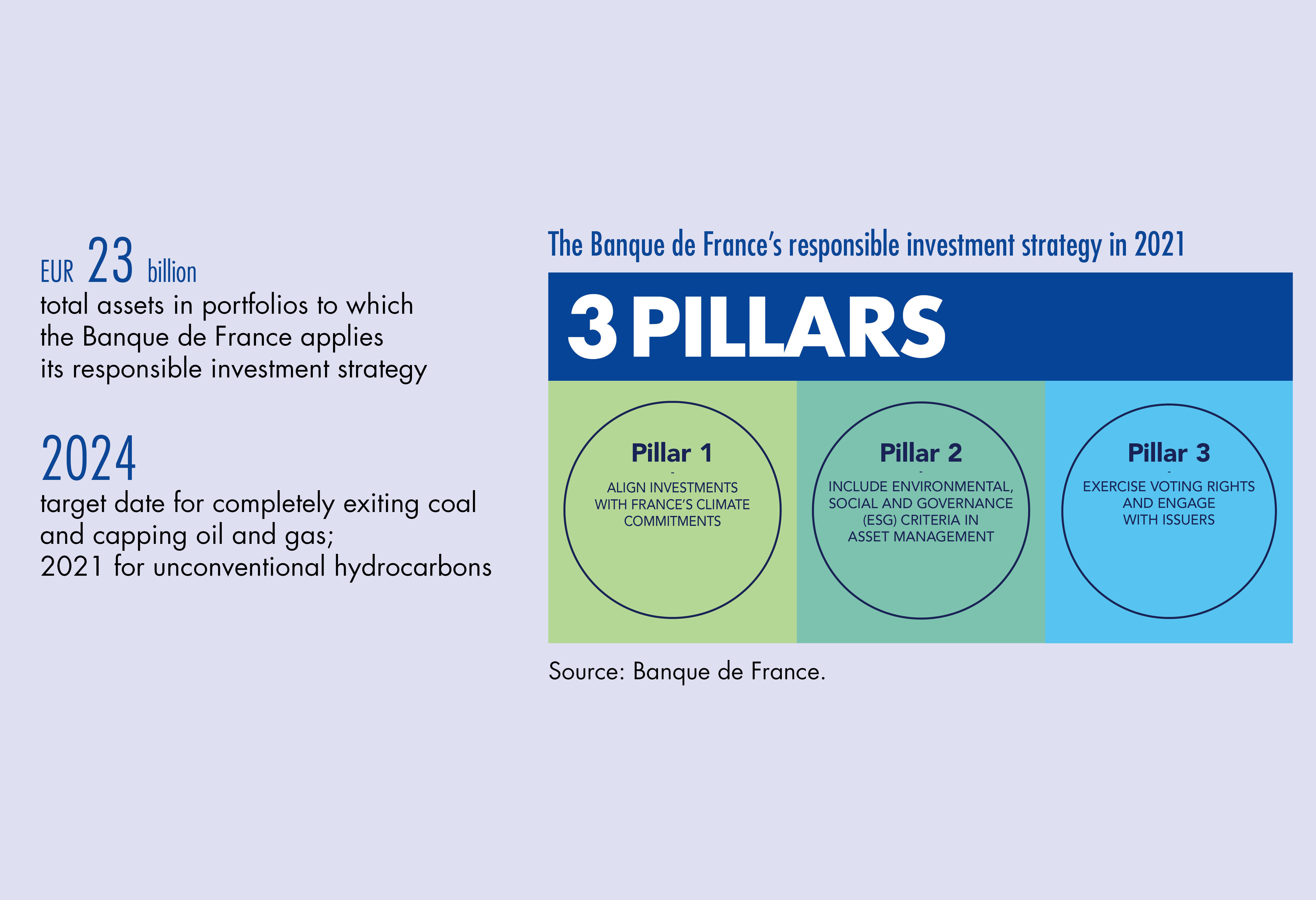

The Banque de France is a pioneering presence within this community. In 2018, it adopted a responsible investment charter, which it implements operationally through the responsible investment strategy applied to its own investments (EUR 23 billion). Recently, the Banque de France announced that it was stepping up its fossil fuel exclusions and aims to exit coal completely in 2024.

1 Sustainable and responsible investment: one of the NGFS’s work priorities

Since its inception, the NGFS has prioritised sustainable and responsible investment

In December 2017, at the One Planet Summit in Paris, the Banque de France took the initiative to create the Central Banks and Supervisors Network for Greening the Financial System (NGFS) alongside seven other central banks and supervisory authorities. It has acted as the secretariat for the network since that time. The NGFS is a “coalition of the willing”: it is a voluntary forum with three key purposes: to share best practices, contribute to the development of climate and environment related risk management in the financial sector and mobilise mainstream finance to support the transition towards a sustainable economy. Climate change is one of many sources of structural change affecting the financial system. Because of its distinctive characteristics, including its irreversibility, its non linearity and its medium/long term time horizon, climate change needs to be considered and managed differently and addressed through specific work projects.

In April 2019, the NGFS published its first comprehensive report during a conference at the Banque de France’s headquarters. The report presented four non binding recommendations to be implemented by member central banks and supervisors:

• No. 1: integrating climate related risks into financial stability monitoring and micro supervision;

• No. 2: integrating sustainability factors into own portfolio management;

• No. 3: bridging the data gaps;

• No. 4: building awareness and intellectual capacity and encouraging technical assistance and knowledge sharing.

Recommendation No. 2 deals specifically with the topic of sustainable and responsible investment. The NGFS encourages central banks to lead by example in their own operations. Without prejudice to their mandates and status (as institutional configurations may vary between jurisdictions), this includes integrating sustainability factors into the management of some portfolios (own funds, pension funds and foreign reserves to the extent possible).

In its report, the NGFS identified several potential benefits to this approach:

• the assessment of sustainability factors, in addition to traditional financial factors, can help central banks, in their capacity as investors, to improve their understanding of long term risks and opportunities and thereby enhance the risk return profile of their long term investments. This approach may also be taken to show an example to other financial participants;

• central banks can reduce reputational risks by acknowledging financial risks related to the transition towards a carbon neutral economy and by addressing these risks proactively in their own (risk) frameworks;

• central banks may decide to employ…

Download the PDF version of this document

- Published on 05/28/2021

- 8 pages

- EN

- PDF (348.27 KB)

Bulletin Banque de France 234

Updated on: 05/28/2021 13:20