Banque de France Bulletin no. 227: Article 9 The structure of income helps to understand changes in the household saving ratio in France

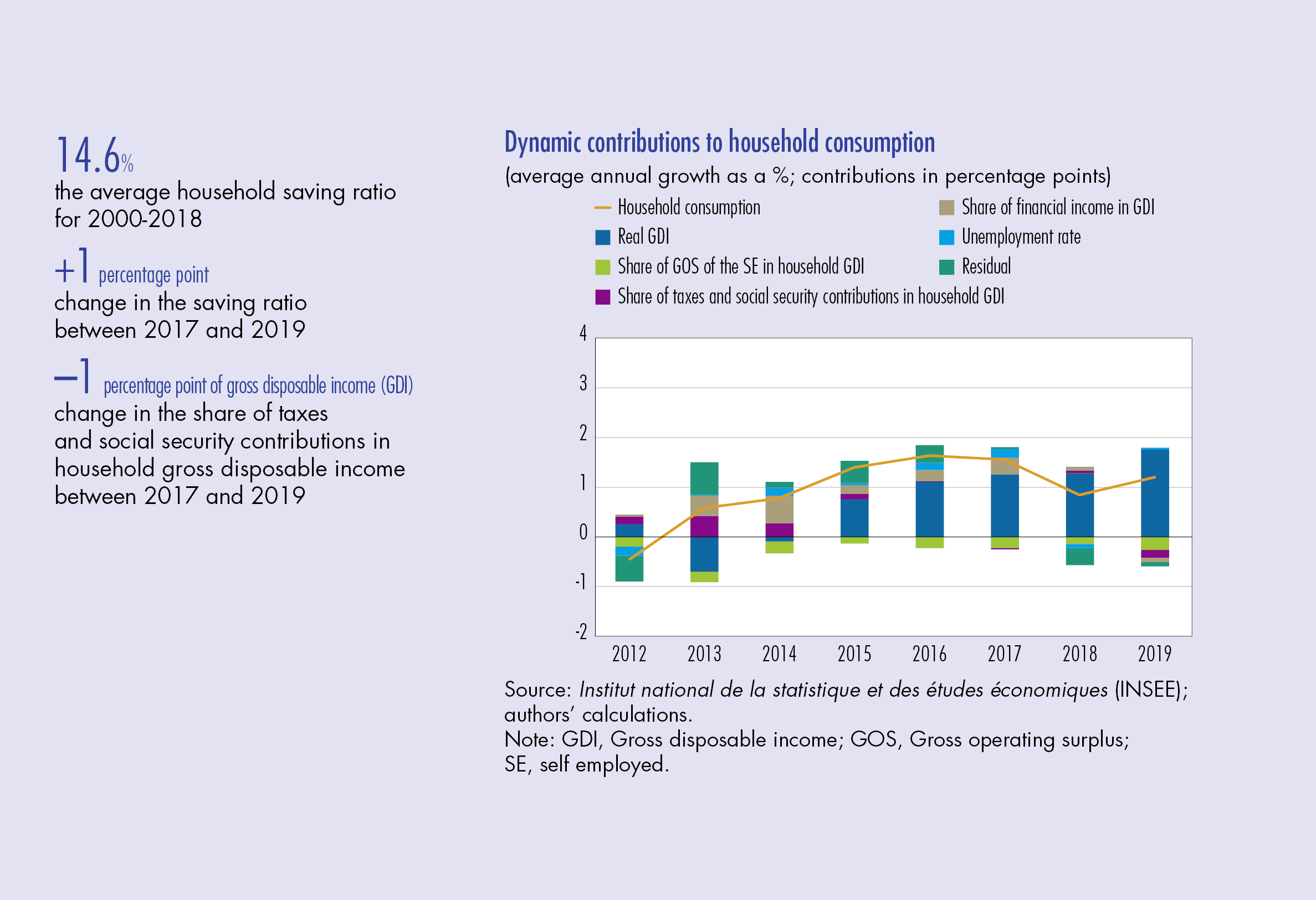

Economic research – The rise in the household saving ratio since the end of 2018 and, more generally, its significant fluctuations over the last ten years call for a fresh look at its macroeconomic determinants. This article proposes a model of household consumption, and thus of the saving ratio, using the share in income of some of its components. This model reflects the idea that changes in the composition of aggregate income are linked to changes in the distribution of income among households with heterogeneous marginal propensities to consume. This approach makes it possible to better explain recent trends in the saving ratio, in particular its decline since 2012 and its subsequent recent rise, with financial income and taxes and social security contributions playing a specific role in these developments.

The household saving ratio peaked at 16.1% in 2009 and then fell to 13.8% in 2017. It has been climbing rapidly since then, with a last recorded peak of 14.8% in the third quarter of 2019. How should we interpret these trends? In particular, is the rise in the saving ratio since the end of 2018 sustainable in a context of continued gains in purchasing power? This article provides an analysis of these trends, with a focus on the structure of household gross disposable income. The results presented in this article are an important component of the macroeconomic assessment used by the Banque de France in its projections since December 2017.

1 At the macroeconomic level, the household saving ratio varies over time

The household saving ratio can vary significantly over time. Starting from a level of over 17% of disposable income in the late 1970s, it declined sharply until the mid‑1980s (11.1% in 1987) and then recovered in the late 1980s. Since 1991, the reference period of this study, the saving ratio has experienced smaller swings, in a range of around 13‑16%, but has not been stationary: it grew at a trend rate until 2008, and has since experienced significant fluctuations.

According to the national accounts, household savings are what remains of their gross disposable income after consumer spending. For a given income level, therefore, looking at the saving ratio is equivalent to considering household consumption. This article is thus part of a long tradition of macroeconomic studies on household consumption based on French data, notably following Bonnet and Dubois (1995), and Sicsic and Villetelle (1995).

In all of these studies, household gross disposable income, or the expectations of it, play a key role as a long‑term anchor of consumer spending. The principle of macroeconomic consumption equations is generally to determine a long‑term target towards which, excluding the effects of short‑term shocks, the saving ratio would tend to converge. However, determining this target is a complex task. Chart 1 shows that, between the early 1990s and the 2008 crisis, the household saving ratio tended to trend upwards. It then may be insufficient to simply consider the historical average for the target of the saving ratio, and the aim of this article is therefore to try to identify long‑term macroeconomic factors influencing household consumption and household savings.

2 Many macroeconomic factors can affect household consumption and savings

In addition to…

Download the PDF version of this document

- Published on 04/03/2020

- 10 pages

- EN

- PDF (514.5 KB)

Bulletin Banque de France 227

Updated on: 04/03/2020 10:07