Banque de France Bulletin no. 232: Article 5 Insurers’ investments weather the crisis despite tensions

Investments by insurers established in France reached EUR 2,813 billion at end-2019, up EUR 211 billion on the previous year. Under pressure from the further fall in interest rates, insurers favoured bonds issued by the private sector and by non-euro area issuers as well as diversification assets (real estate, structured securities, etc.).

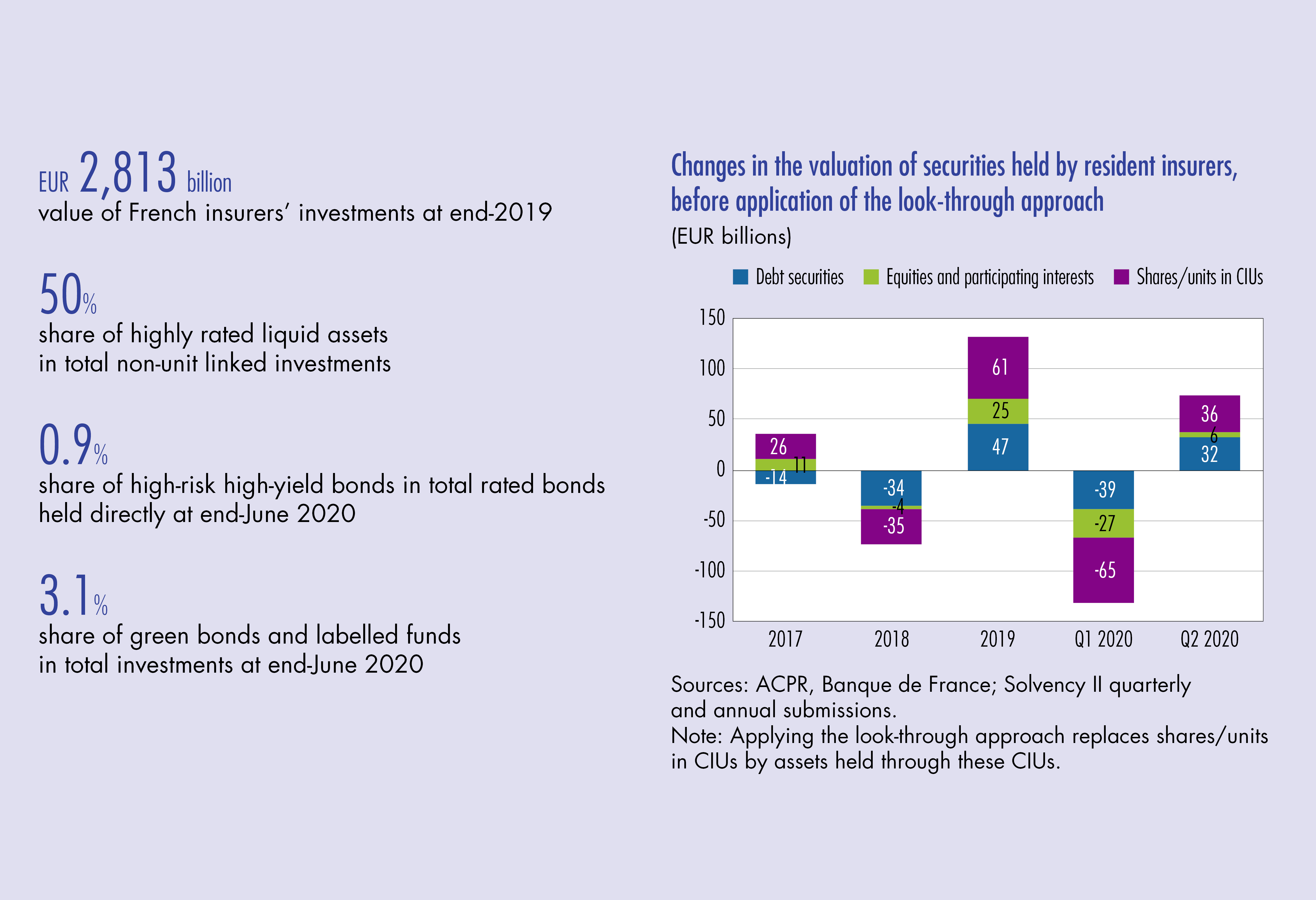

Thanks to large unrealised capital gains, they were able to partly cushion the health and economic

crisis in the first half of 2020. While asset valuations deteriorated sharply in the first quarter of 2020 (down EUR 131 billion, i.e. almost all the increase recorded in 2019), the market rebound in the second quarter offset more than half of this decline. The crisis had little effect on the ratings of the bonds held. Liquid investments enabled insurers to meet their short-term commitments.

1 The situation of insurers in 2019, prior to the health crisis: stable asset allocation in a low interest rate environment

In 2019, with EUR 2,813 billion worth of assets, France was still the leading market in the euro area in terms of balance sheet size, as insurers established in France and subject to the Solvency II directive held 35% of investments managed by euro area insurers. Life and composite insurance remains by far the leading activity of French insurers: it accounts for 91% of insurers’ outstanding investments.

Assets allocated towards safe, diversified and long-term investments

It is the responsibility of insurers to hold sufficiently safe and liquid assets in order to have the necessary funds should an unexpected event occur in the future. Insurers therefore have a stable asset allocation from year to year (see Chart 1), the slight changes observed between 2018 and 2019 being mainly due to valuation effects related to rising stock markets. The proportions of shares/units in collective investment undertakings (CIU) and equities are up (by 0.8% and 0.4% respectively), while those of bonds and fixed assets are down (by 1.2% and 0.1% respectively).

Insurers continue to favour bonds, which in 2019 accounted for 58% of investments, mainly sovereign bonds (25% of total outstandings) and financial corporate bonds (22%). Insurers hold mainly debt securities with a maturity of more than one year (for an amount of EUR 1,599 billion, compared with 20 billion securities with a maturity of less than one year), generally held to maturity, which mitigates the effects of cyclical shocks.

Equities and participating interests account for 10% of investments. However, this overall figure masks a significant difference between life and composite insurers, which hold 8% of their asset portfolio in equities and participating interests, and non-life insurers, which holdmore than a quarter (27%) of their portfolio in equities and participating interests. This difference is mainly due to the fact that non-life insurers hold a greater proportion of participating interests than life and composite insurers (respectively 23% and 4% of the outstanding amount). In the end, direct investments in equities reach the same proportions for non-life, life and composite insurers.

Holdings of shares/units in CIUs remain stable. They account for 27% of investments (26% in 2018). As regards the sectoral allocation of directly held investments, insurers invest primarily in the financial sector (31% of their investments), given the weight of their participating…

Download the PDF version of this document

- Published on 03/08/2021

- 16 pages

- EN

- PDF (570.12 KB)

Bulletin Banque de France 232

Updated on: 03/09/2021 09:19