Why and how to develop the international role of the euro?

Trade and financial globalisation, as well as the economic and health crises that have marked the international monetary system over the past decade, are leading us to re-examine the cost-benefit balance of the internationalisation of the euro. Developing the international role of the euro would result in a rebalancing of the international monetary system in favour of the euro, with potentially beneficial effects in terms of financial and macroeconomic stability. This article looks at the reasons for promoting the international role of the euro, but also the associated risk factors. While the balance remains neutral for European monetary policy, enhancing the international role of the euro would nevertheless shield the euro area from global fluctuations. Above all, policies that contribute to strengthening the international role of the euro, in particular the promotion of the capital markets union and green bonds, would also enhance the euro area’s resilience and long-term growth.

The policy of neutrality endorsed in the early days of the euro implied that the European Central Bank (ECB) would neither hinder nor encourage the international role of the euro. It was adopted following an assessment of the costs and benefits of the internationalisation of the euro. Since that first assessment, the geopolitical and institutional context, with in particular the decline in multilateralism, and the economic context, with globalisation, have changed, altering the cost-benefit balance of the internationalization of the euro.

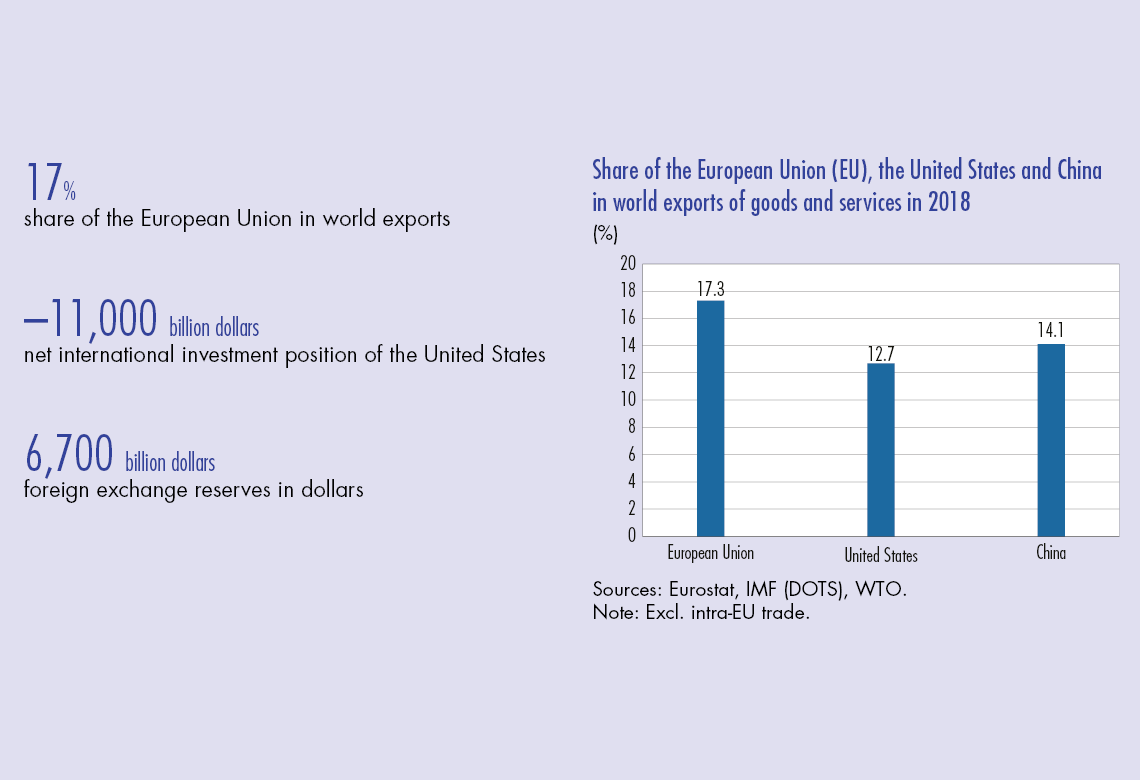

First of all, globalisation has taken the form of a rise not only in trade in goods and services, but also in capital flows. Commercially and financially open economies such as those of the euro area have greater incentives to protect themselves against import price fluctuations and to ensure stable external financing. Assuming that the current health crisis does not change previous views, which nobody can say at this point, growing trade openness also makes the euro area economy increasingly sensitive to developments in the rest of the world.

Globalisation has also resulted in a concentration of channels of exchange, as illustrated by the role of the small number of major bank card networks in retail payments or of SWIFT in interbank settlement messaging. This enhances the capacity of the country at the heart of the international monetary system to control trade and financial flows. More recently, the digital giants have multiplied initiatives to promote the use of means of payment sometimes referred to as “stablecoins”, but in fact closer to crypto assets, based on the global networking effect of their digital platforms.

It is therefore legitimate today to address the issue of the position of the euro in the international monetary system (IMS). This article thus looks at the advantages of developing the international role of the euro and the policies that would contribute to this development.

1 Why strengthen the international role of the euro?

Strengthening the international role of the euro will mitigate the undesirable effects of the dominance of a single currency

Today, businesses, debt issuers and investors use the US dollar as it serves their interests: by concentrating on a single currency, they lower their financing costs and foreign exchange risks. Businesses are able to charge and settle their transactions while limiting foreign exchange costs, either because their revenues and expenses are in dollars or because dollar financing is particularly developed and plays a…

Télécharger la version PDF du document

- Publié le 23/09/2020

- 10 page(s)

- EN

- PDF (285.72 Ko)

Bulletin Banque de France 229

Mis à jour le : 23/09/2020 10:19