Forecasting Euro Banknotes in Circulation with Structural Time Series Models in Times of the COVID-19 Pandemic

As part of the Eurosystem’s annual banknote production planning, the national central banks draw up forecasts estimating the volumes of national-issued banknotes in circulation for the three years ahead. As at the end of 2021, more than 80 per cent of euro banknotes in circulation (cumulated net issuance) had been issued by the national central banks of France, Germany, Italy and Spain (collectively referred to as the “4 NCBs”). To date, the 4 NCBs have been using ARIMAX models to forecast the banknotes issued nationally in circulation by denomination (“benchmark models”). This paper presents the structural time series models developed by the 4 NCBs as an additional forecasting tool. According to the forecast accuracy measures employed, the Structural Time series Models (“STSMs”) outperform the benchmark models at each of the 4 NCBs and for most of the denominations. However, it should be borne in mind that the statistical informative value of this comparison is limited by the short projection period of just 12 months.

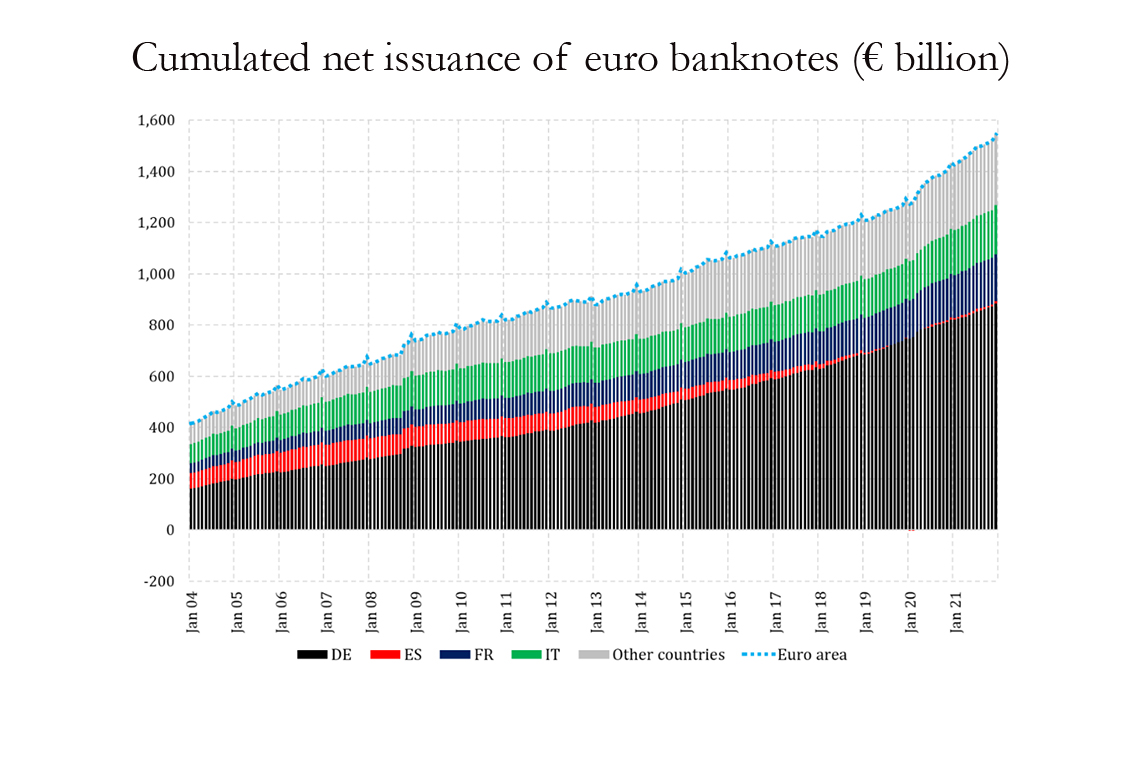

This paper presents the outcomes of a research study that focuses on forecasting the net issuance of euro banknotes by denomination for France, Germany, Italy, and Spain. These 4 NCBs account for a substantial proportion of the total euro area circulation, exceeding 80 percent (see Figure).

The annual determination of banknote production requirements is a collaborative effort between the national central banks of the Eurosystem and the European Central Bank. The primary objective of this exercise is to prevent imbalances in banknote supply, avoiding both shortages and excessive surpluses. The overarching goals are to ensure that credit institutions and citizens have an appropriate quantity of banknotes, maintain the quality standards of cash in circulation, and optimize cost efficiency.

The benchmark models currently used for national banknote requirement planning at the 4 NCBs essentially belong to the ARIMAX family. However, the existing forecast models employed in the euro area heavily rely on assumptions about the underlying properties of the relevant time series. This paper seeks to address certain limitations of these models by introducing estimates based on STSMs for France, Germany, Italy, and Spain. The main objective is to enhance the accuracy of forecasts regarding the net issuance of euro banknotes across these countries.

STSMs represent a very broad class of time series models including ARIMAX models and exponential smoothing models. They break a time series down into its unobservable components such as trend and seasonal components. As in regression models, explanatory variables and intervention variables can also be incorporated. Here the explanatory variables represent calendar effects on banknotes in circulation, and intervention variables stand for special events which lead to trend breaks and outliers.

The results obtained from the study indicate a favorable performance of the proposed models in forecasting net banknote issuance at a twelve-month horizon. In certain instances, these models exhibit superior predictive capabilities compared to the current models used by individual national central banks (as measured by a lower ex-post RMSE for STSMs than the ARIMAX models). It is important to acknowledge, however, that this comparison is based on a relatively short time interval. It is worth noting that a variety of crisis-related events turned out to be significant. These include global crises like the great financial crisis and the COVID-19 pandemic. Moreover, intervention variables for the euro cash changeover and the halt to €500 banknote issuance also play a role.

Prior to integrating these models into the coordinated banknote demand forecasting exercise, which spans multiple years, further analyses are necessary to evaluate their long-term forecasting performance. This step is crucial in assessing the viability and effectiveness of the proposed models within the broader context of forecasting euro banknote issuance.

Télécharger la version PDF du document

- Publié le 21/07/2023

- 81 page(s)

- EN

- PDF (5.22 Mo)

Mis à jour le : 21/07/2023 15:24